Exploring the China-U.S. Gaming Dynamics

The trade relationship between China and the United States is one of the dominant economic stories of the past two decades. In those years, the U.S. has shifted from supporting unfettered trade with China to a more restrictive stance with the imposition of import tariffs and export restrictions.

China, meanwhile, has grown substantially and became the world’s leading manufacturer. Its technology and gaming companies have become globally competitive in their own right, leading nearly everyone to rethink the trade relationship as a whole.

Within the gaming business, the two countries have only grown closer and become more integrated. Chinese gaming companies acquired large stakes in American firms and invested heavily in building out American studios. Chinese games grew their market share in the U.S. significantly too — first on mobile, then on console and PC.

American companies also increased their exposure to China. Steam has become incredibly popular, and U.S. publishers both invested in Chinese development teams and licensed their games to local distribution partners.

A Reversal of Fortune

The nature of the U.S.-China gaming relationship has been slowly changing for a few years, but that change has accelerated more quickly in the past 10-12 months, especially in how Chinese firms approach the U.S. market.

Chinese firms stopped doing M&A in the U.S., and minority/venture funding also declined due to concerns over regulatory approval. This, however, did not preclude Chinese publishers from setting up new American subsidiaries, but even that approach may be slowing down.

Several high-profile partnerships between U.S. and Chinese gaming firms broke down as well. EA shuttered Apex Legends Mobile, which it had built with Tencent, and NetEase and Blizzard had a high-profile breakup over World of Warcraft licensing. (The two parties later agreed to a new deal.) Activision also chose to forgo partnership with Tencent on the launch of Call of Duty: Warzone Mobile, instead developing the game internally, despite the success of its collab with Tencent on Call of Duty: Mobile.

China’s regulatory regime heavily favors domestically produced games, and given the scale the market has achieved, consumers and domestic publishers aren’t reliant on imported games, which constitute a small portion of overall consumption. This dynamic is also seen in China’s film market.

Chinese companies have also begun withdrawing from their U.S. investments, while their share of American gaming markets has only accelerated. These trends, which may initially appear oppositional, are actually fundamentally intertwined, and explained by four underlying factors that began years ago.

- China has steadily become the largest domestic market for gaming — first in mobile, then in PC.

- Internationally, Chinese exports have consistently grown in market share — again, first in mobile, and then in PC and console.

- Development costs in Western countries increased significantly relative to China. At the same time, Chinese developers now reach or exceed product quality parity.

- Regulatory hurdles have constrained both Chinese and American firms over the past decade. Most recently, U.S. actions have caused Chinese firms to dial back their U.S. investments.

China’s Domestic Gaming Market

China became the world’s largest mobile gaming market in 2016, and as of February 2025, over 50% of Steam’s playerbase uses Chinese as the client language, making China’s share of the largest PC gaming audience ever larger.

China’s mobile market has been heavily regulated through a series of state crackdowns on the sector beginning in 2021, though policies have tightened and loosened over the years. This has further reinforced the dominance of established domestic publishers over newcomers — NetEase and Tencent together had a combined 61% market share in 2022, continuing a long history of shared dominance.

Unlike mobile, Steam is relatively open and accessible, and is one of the few internet platforms with wide availability and shared usage in both China and the West. Despite its massive presence in the country, Steam’s global service is not officially licensed for use in China, and requires workarounds to access.

A shift in regulatory enforcement could easily threaten Steam’s precarious dominance in the country — and the ripple effects of a Chinese regulatory change around Steam would be heavily felt by the rest of the world too.

Source:

https://www.matthewball.co/all/stateofvideogaming2025, https://www.vgchartz.com/article/464131/it-takes-two-sales-top-23-million-units-a-way-out-tops-11-million-units/, https://gamerant.com/black-myth-wukong-total-sales-january-2025/

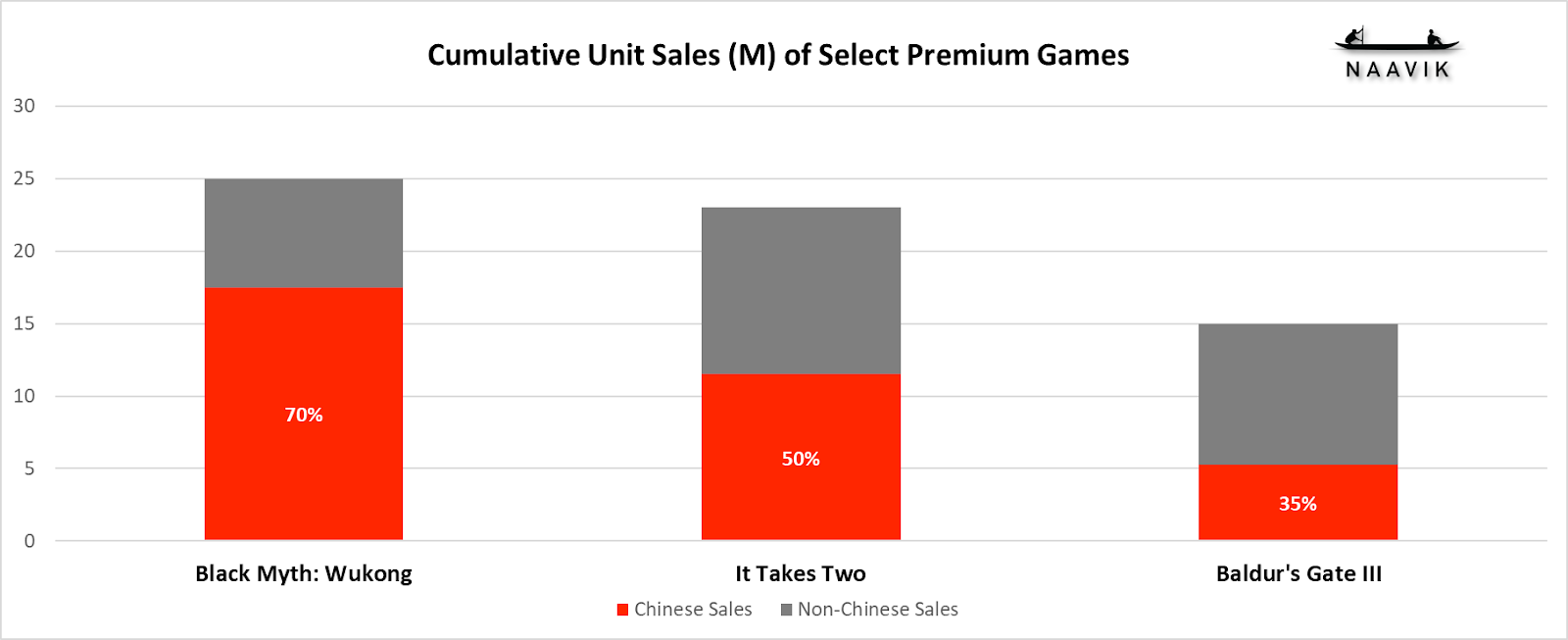

Source: Matthew Ball, VGChartz, Gamerant, 80.lv

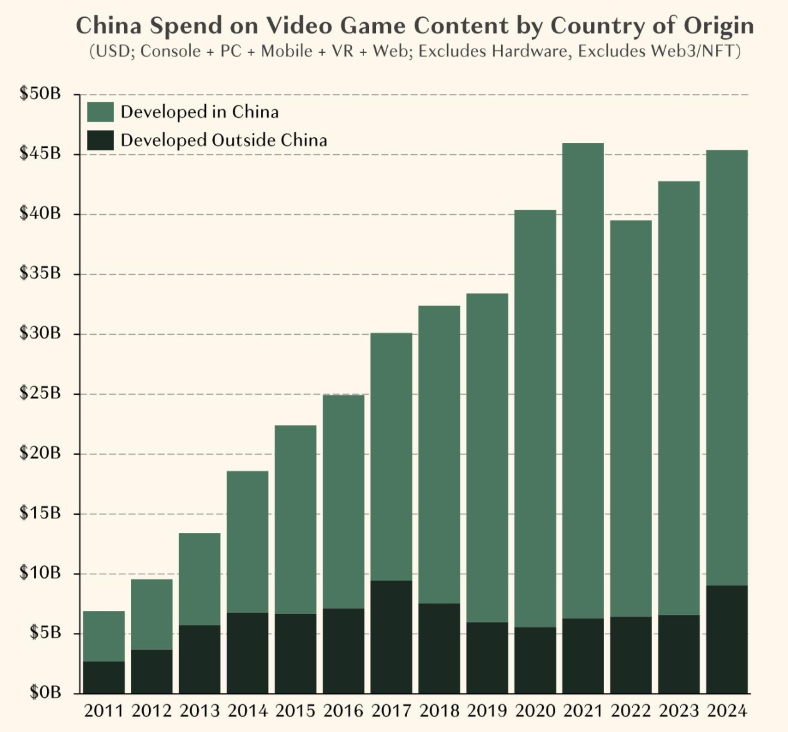

A third of global game industry growth since 2011 can be attributed to Chinese consumers, whose 23% share of the global market is equivalent to $45B. Some Western titles do break through to these players — Hazelight’s titles have been particularly popular — but over 22% (less than $10B) of Chinese consumer spending goes to games developed outside China — a ratio that has largely declined since 2017.

This does leave room for outsize successes such as It Takes Two and Split Fiction, top licensed sports games, and the occasional Western indie hit getting 99% of their CCU from China. But the vast majority of the market remains fairly inaccessible to all but the biggest games.

Source: Matthew Ball

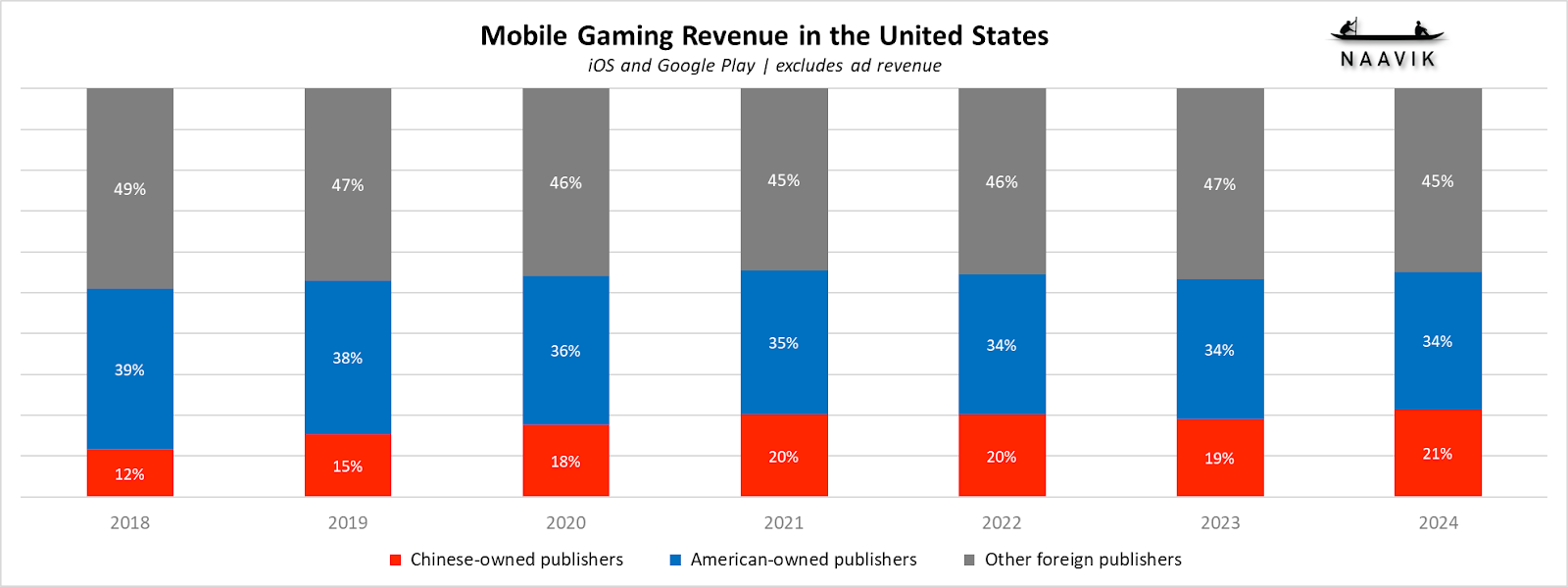

China’s Export SuccessWhile China’s domestic mobile market accounts for 31.7% of the total global mobile gaming market, Chinese mobile publishers now capture 47% of the full global market as well. The steady growth in exports became an increasing priority after highly restrictive domestic regulations saw Chinese publishers start to prioritize international markets, especially in mobile.

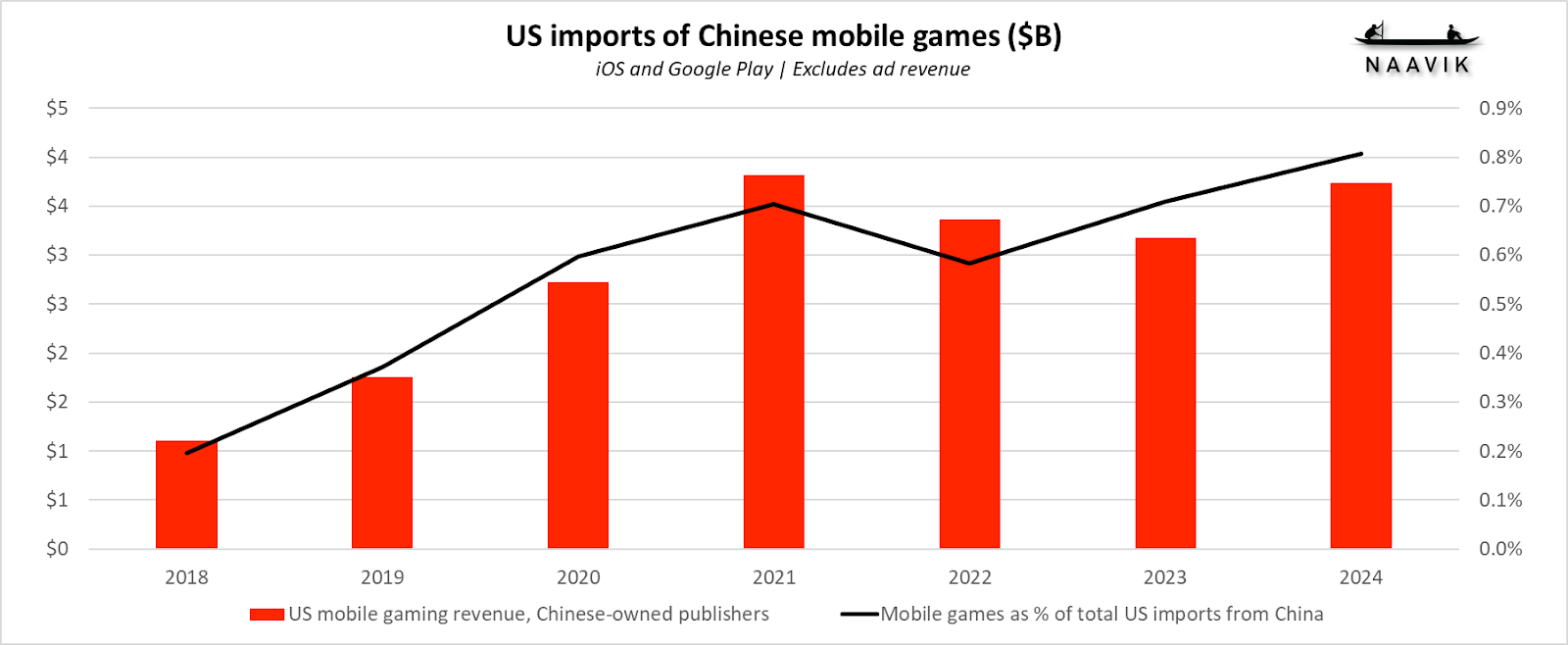

This trend, best exemplified by titles as wide-ranging as Genshin Impact, Top War, and Harry Potter: Magic Awakened, saw Chinese-associated publishers increase their market share nearly everywhere. In the U.S., the largest mobile gaming market, these publishers’ revenue grew 3.4 times from 2018-2024, while American publishers’ domestic revenue only grew 1.6 times.

Source: Sensor Tower

While mobile games are a small category of the entire range of products the U.S. imports from China, mobile gaming’s share of total Chinese imports has consistently climbed since 2018 (barring the industry-wide decline in 2022).

Sources: Sensor Tower, tradingeconomics.com

PC gaming in China has a long history, but for years the industry was largely focused on the domestic MMO market. Only in the mid-2010s did the first Chinese studios targeting the global PC/console market begin to emerge, often supported by Tencent, NetEase, or other strategic sponsors.

Tides of Annihilation, from Tencent-backed developer Eclipse Glow Games, was a standout game from Sony’s China Hero Projected, revealed at State of Play 2025 | Source: IGN

Sony’s China Hero Project offers a compelling case study. First launched in 2017 as a content scouting program for potential PlayStation titles, its growing importance in Sony’s overall content strategy is clear.

At the 2025 State of Play event, two of the marquee games presented were from the China Hero Project. The program has released just seven titles since its inception, but has 17 announced projects currently in development.

Source: SteamDB

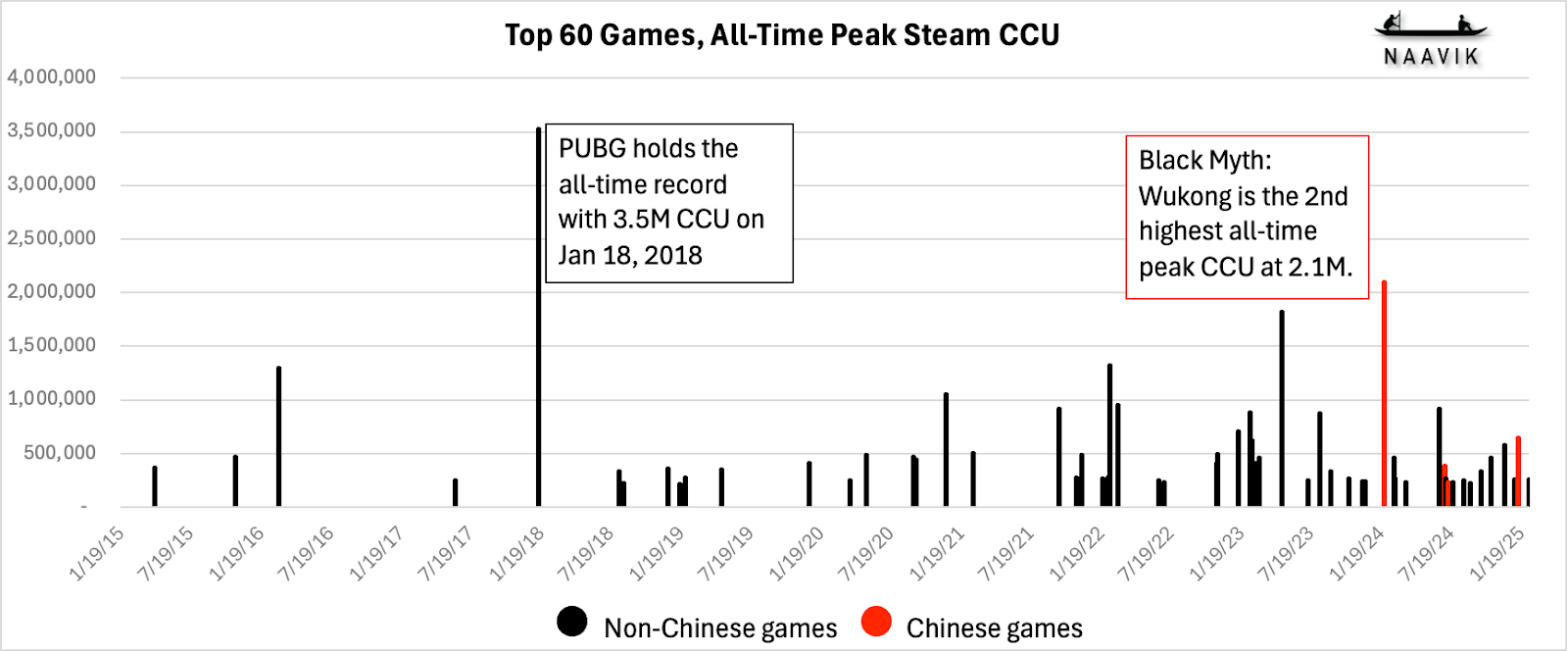

Chinese developers began to see outsized success in PC and console games only last year, though this built on the foundation provided by the strength of the country’s mobile gaming industry. In 2024, Naraka: Bladepoint reached 235K Steam CCU on July 3, quickly followed by Once Human 11 days later — both published by NetEase.

Black Myth: Wukong became Steam’s second-highest ever peak CCU at 2.1M when it launched in August, and before the end of the year, NetEase’s Marvel Rivals, Tencent’s Delta Force, and Paper Games’ Infinity Nikki all launched on PC and consoles and found international success.

At the same time, as the quality and appeal of Chinese-developed PC/console games increased, the relative cost of Western game development also grew. Chinese developers have now proven they can succeed consistently at large scale in Western markets, and their games are much cheaper to develop than those from Western studios.

The Chinese “996” work culture in tech and games may further increase the relative ROI of Chinese studios compared to Western developers. This logic may have informed NetEase’s decision to dramatically scale back, if not cut entirely, its large portfolio of international studios.

Economic Forces Have Been More Impactful than Regulatory Changes or Trade Policies

While the potential impact to game console shipments during a trade war is not certain, other regulatory changes have meaningfully reduced Chinese involvement in Western gaming markets.

Tencent gave up its seats on the boards of Epic Games due to allegations of anticompetitive behavior through its ownership of Riot Games after a U.S. Justice Department investigation. Apps from ByteDance were removed from U.S. app stores in January before being restored, including hit mobile CCG title Marvel Snap (in which NetEase is an investor). These changes were sudden, but they build upon the longer-term economic forces changing the U.S.-China gaming relationship.

Global game studios, publishers, and other stakeholders should be taking China very seriously. Appreciating, and even imitating, Chinese gaming firms’ approach to work culture, use of AI, and market preferences will become critical to the competitiveness of Western firms globally.

Of course, the regulatory and trade barriers between China and the West are lopsided — foreign firms must publish their games in China through a domestic partner, and the number of foreign-developed games is strictly controlled. No such limitations exist for Chinese publishers when they bring their games to other countries.

Thus far, countries have focused their attention on banning specific apps, as India did with PUBG Mobile, but it stands to reason that more structural restrictions could eventually come into play. This could have the effect of slowing, or even reversing, Chinese publishers’ growing market share globally.

Source: Naavik digest

熱門頭條新聞

- Sony’s Soneium teams with Animoca Brands blockchain for anime digital IDs

- XP Game Summit 2025

- ARENA BREAKOUT: INFINITE RELEASING APRIL 29

- Blizzard’s Game Director joins NG25 Spring

- The 2025 3D Creative Talent Showcase Competition is coming with a bang!

- Guangzhou Business College and Numerex Global Initiate Strategic Cooperation in Artificial Intelligence

- A Poster Reflecting the Festival’s Vibrancy and Passion!

- SAG-AFTRA Announces New Video Game Agreements for Students and Game Jams