Blue-collar workers are avid supporters of Kuaishou

What will determine the future of the company is not the incremental users in the fifth ring, but the 450 million blue-collar workforce.

Kuaishou is the favorite short video platform for blue-collar workers. It can be said, ” TikTok has the quiet, good and delicate life that you city people envy, while Kuaishou lets us blue-collar workers and ordinary people eat, drink and play!” In essence, these are all spiritual pursuits, and no one should be laughed at for these.

Kuaishou’s “family” culture has been vividly reflected in the live streaming business. Before the first quarter of 2020, live streaming rewards once generated enough cash flow that it contributed the most to revenue. After the company’s strategic adjustment, the advertising business later flourished as well, but the original intention of refined operation stock users has not changed.

Blue-collar workers also have families, friends, and employers. No matter which kind, they are all Kuaishou users, which is also an inherent factor to why the GMV growth rate of Q2 e-commerce business far exceeds that of the domestic consumer market.

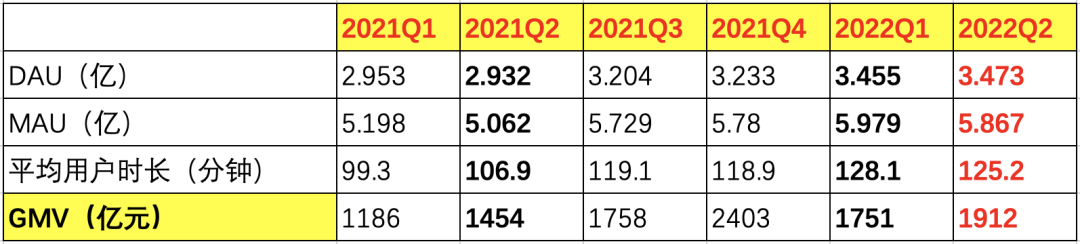

Here we must mention the third area of business. The second quarter of the e-commerce GMV results achieved 191.2 billion yuan, and a year-on-year and month-on-month growth of 31.5% and 9%, respectively. Although this is not a record high, as the Q4 in 2021 reached 240.3 billion yuan, but it is already a very good result in domestic e-commerce. You should know that Alibaba and Vipshop both have a decline in GMV and revenue.

The external factor is a series of activities that Kuaishou enables merchants and brands.

For example, the month-on-month and year-over-year revenue doubling of Kuaishou merchants, and the monthly sales activity of brand merchants. For example, repeat customers based on platform culture have directly increased; live-streaming e-commerce has also matured, no longer limited to non-target clothing and cosmetics categories, and expanded multiple SKU, including food, beverage and home appliances, to improve the consumer (user) experience directly from the supply side.

In addition, affected by the macro environment, consumer confidence is insufficient, and the traditional e-commerce industry is under pressure. Kuaishou is slightly different, since Kuaishou users are mostly from the sinking market. Compared to urban residents, rural residents are less sensitive to changes in the economic cycle.

For example, even without the expected income, rural residents still have their lands and yards. They can grow their own food and survive on their crops. For example, in rural villages 10 yuan’s worth of food at the supermarket can last for several days, this cannot be compared with the city. For example, savings, rural double income families, indeed probably earn more than the average white collar or middle-class. It’s hard to believe, but this is exactly the advantage of Kuaishou at the moment.

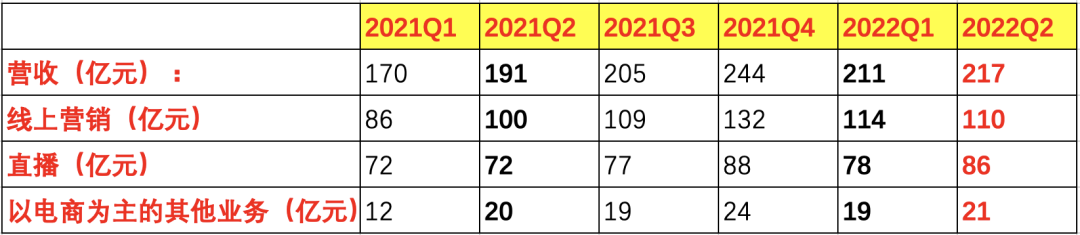

In the second quarter, the company’s total revenue was 21.7 billion yuan, while achieving a year-on-year growth rate of 13.4% and a sequential growth rate of 2.8%.

Its three businesses: online marketing (advertising), live broadcasting (tipping), and other e-commerce-based businesses were 11 billion yuan, 8.6 billion yuan and 2.1 billion yuan respectively, all of which achieved year-on-year growth again, but apart from the advertising business, the latter two also achieved month-on-month growth.

The online marketing business, with the highest revenue proportion, roughly consists of three parts: brand advertising (one-stop service), information flow advertising, and e-commerce solutions. The current quarterly decline in quarter-on-quarter growth directly corresponds to a sharp reduction in marketing expenses, dropping from 11.3 billion yuan in the same period a year ago and 9.5 billion yuan in the first quarter to 8.8 billion yuan in the second quarter.

熱門頭條新聞

- Crypto Rogue Games Closes $1,5M Seed Round

- Skate Fish Coming Soon to iOS and Android

- new superpowered video game set in the vibrant world of PJ Masks: Power Heroes

- State of Unreal Roundup: Unreal Engine 5.4

- VAMPIRE THERAPIST

- Cooler Master Unveils the MK770: The Ultimate Mechanical Gaming Keyboard for Customizability and Performance

- Beyond Announces Runaways for Apple Vision Pro™

- Wobbledogs go six feet under in the Unfinished Basement object pack