Total PC GPU shipments increased in US

Total PC GPU shipments increased by 6% from last quarter and 20% year to year.

Jon Peddie Research reports the growth of the global PC-based graphics processor unit (GPU) market reached 76.2 million units in Q4’23 and PC CPU shipments increased an astonishing 24% year over year, the biggest year-to-year increase in two and a half decades. Overall, GPUs will have a compound annual growth rate of 3.6% during 2024–2026 and reach an installed base of almost 5 billion units at the end of the forecast period. Over the next five years, the penetration of discrete GPUs (dGPUs) in the PC will be 30%.

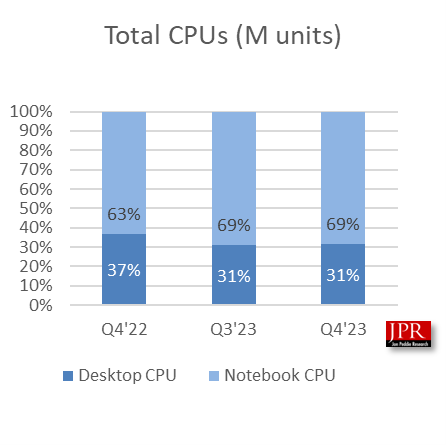

Figure 1. Three consecutive quarters of growth put the GPU market back in a growth phase.

Year-to-year total GPU shipments, which include all platforms and all types of GPUs, increased by 20%, desktop graphics decreased by -1%, and notebooks increased by 32%.

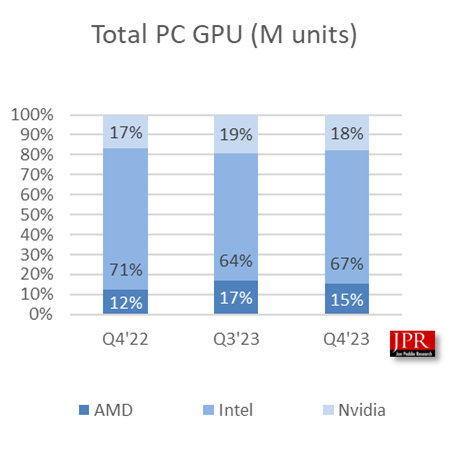

AMD’s overall market share decreased by -1.4% from last quarter, Intel’s market share increased 2.8%, and Nvidia’s market share decreased by -1.36%, as indicated in the following chart.

Figure 2. Quarterly shipments, market share percentages, and year-to-year results.

Overall GPU unit shipments increased by 5.9% from last quarter. AMD’s shipments decreased by -2.9%, Intel’s shipments rose 10.5%, and Nvidia’s shipments decreased by -1.5%.

The GPU’s overall attach rate (which includes integrated and discrete GPUs, desktops, notebooks, and workstations) in PCs for the quarter was 113%, down -3.3% from last quarter.

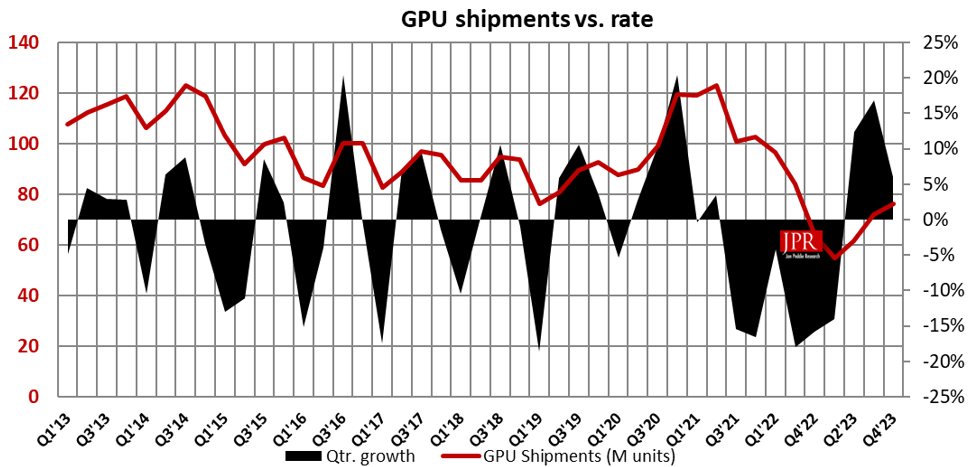

Desktop graphics add-in boards (AIBs that use discrete GPUs) increased by 6.8% from the last quarter. The overall PC CPU market increased by 9.0% quarter to quarter and increased 24.0%

year to year.

Figure 3. CPU shipments by platform share and units.

The fourth quarter is typically flat to up compared to the previous quarter. This quarter was up 5.9% from the last quarter, which is above the 10-year average of -0.6%.

“The fourth quarter is a bit of a bellwether for the following year, and this quarter it was up, suggesting 2024 will be a strong year for the PC,” said Dr. Jon Peddie, president of Jon Peddie Research. “The PC and CPU makers are introducing the so-called AI PC in the hopes of stimulating the market with a new shiny thing. We’ve had AI-capable PCs for over a decade and the issue has been (and still is), where is the AI they will accelerate? It’s coming, and early examples from Adobe, Microsoft, and the CAD suppliers are good examples. But it won’t hit mainstream everyday utilization probably until the end of the year at the earliest. Therefore, we suggest caution in one’s optimism and enthusiasm.”

GPUs and CPUs are leading indicators of the PC market because they go into a system while it’s being built, before the suppliers ship the PC. However, most of the semiconductor vendors are guiding down for the next quarter the average guidance for Q1’24 is -7,1% but the weighted average guidance is -2.8%. Last quarter, they guided 7%, which was too high by 1%. The 10-year average for Q3-to-Q4 shipments is 0.9%, so happy days may not be completely here just yet. However, some organizations’ reading of the tea leaves sees the two consecutive quarters of growth as the harbinger of a fantastic 2024, just like they saw the Covid demand for Chromebooks as the beginning of an explosive demand for Chromebooks—that hasn’t quite happened yet.

The above information and more can be found in the new Q4’23 edition of Market Watch. JPR also publishes a series of reports on the graphics add-in board market and PC gaming hardware market, the latter of which covers the total market, including systems and accessories, and looks at 31 countries.

About Jon Peddie Research

Jon Peddie Research has been active in the graphics and multimedia fields for more than 30 years. JPR is a technically oriented multimedia and graphics research and consulting firm. Based in Tiburon, California, JPR provides consulting, research, and other specialized services to technology companies in various fields, including graphics development, multimedia for professional applications and consumer electronics, high-end computing, and Internet-access product development. JPR’s Market Watch is a quarterly report focused on PC graphics controllers’ market activity for notebook and desktop computing.

熱門頭條新聞

- Slow-Motion Collapse: How Nostalgia, Streaming, and Short-Sightedness Undermined Hollywood’s Future

- PBS NOVA / GBH JOINS THE PRODUCTION OF ZED AND ARTE’S PREMIUM DOCUMENTARY THE LOST TOMBS OF NOTRE-DAME

- Biopunk Action Title Sonokuni Launching Early 2025

- LifeAfter Season 7 “The Heronville Mystery” Brings a Brand New Folklore Horror Theme for a Unique Survival Experience

- 2024 Developer Showcase and look ahead to 2025

- Jumping Jazz Cats will launch on PC January 30th

- Lexar Announces Two Portable SSDs

- Quell Announces Hit Game Shardfall is Coming to VR