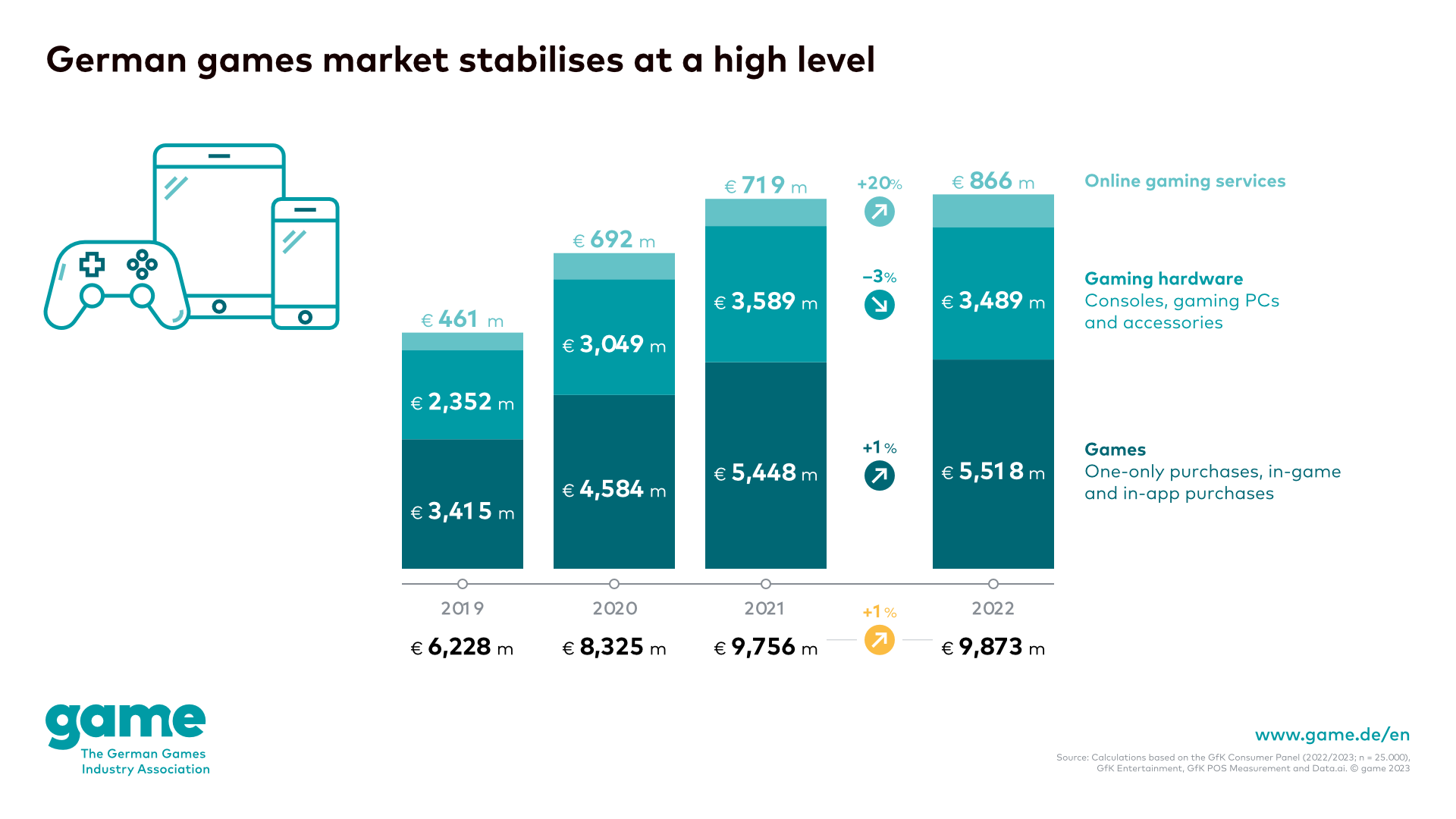

German games market stabilises at a high level

- The market for games, gaming hardware and fees for online services grew by 1 per cent in Germany in 2022

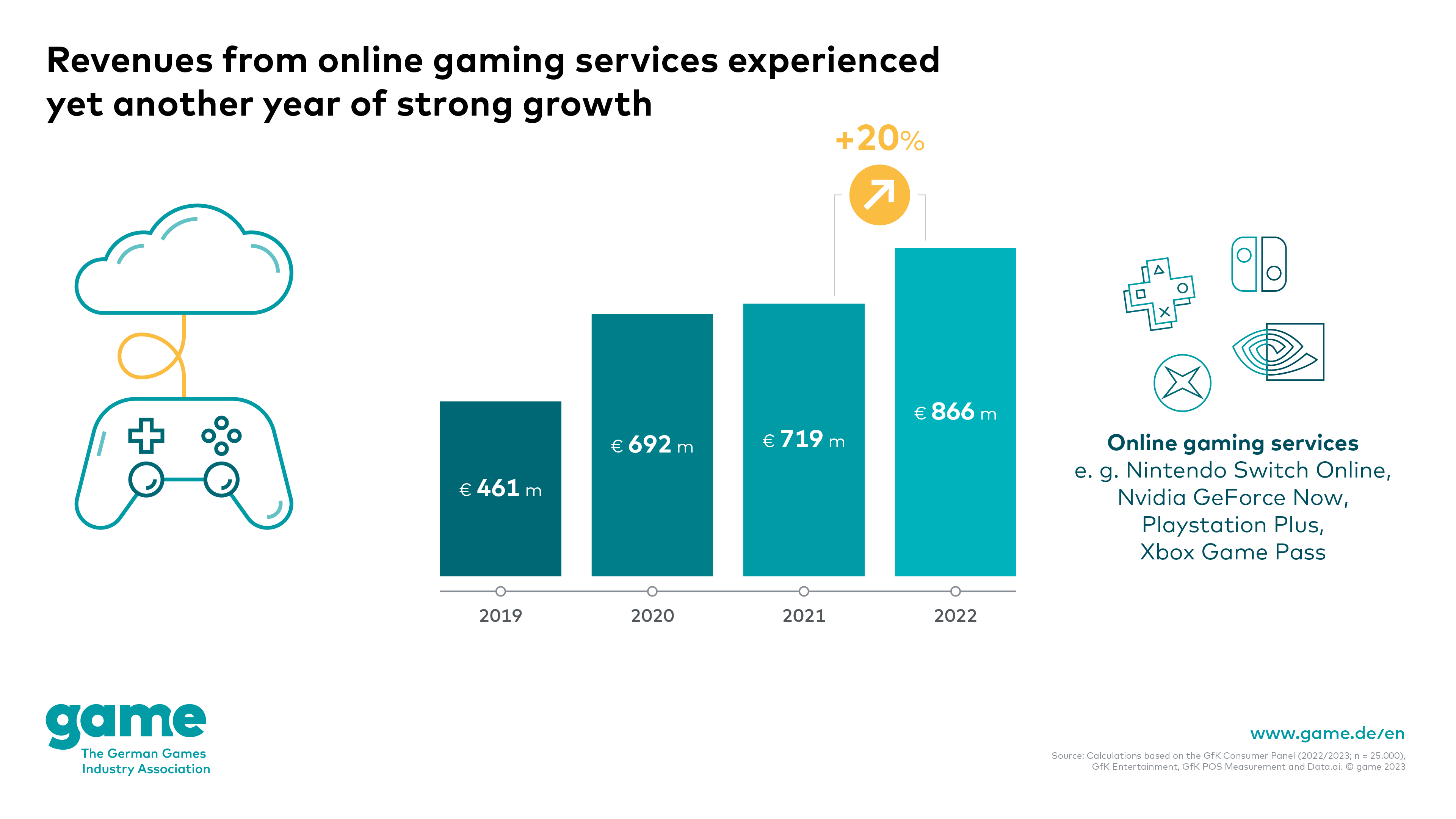

- Sales revenue from online gaming services increases by 20 per cent

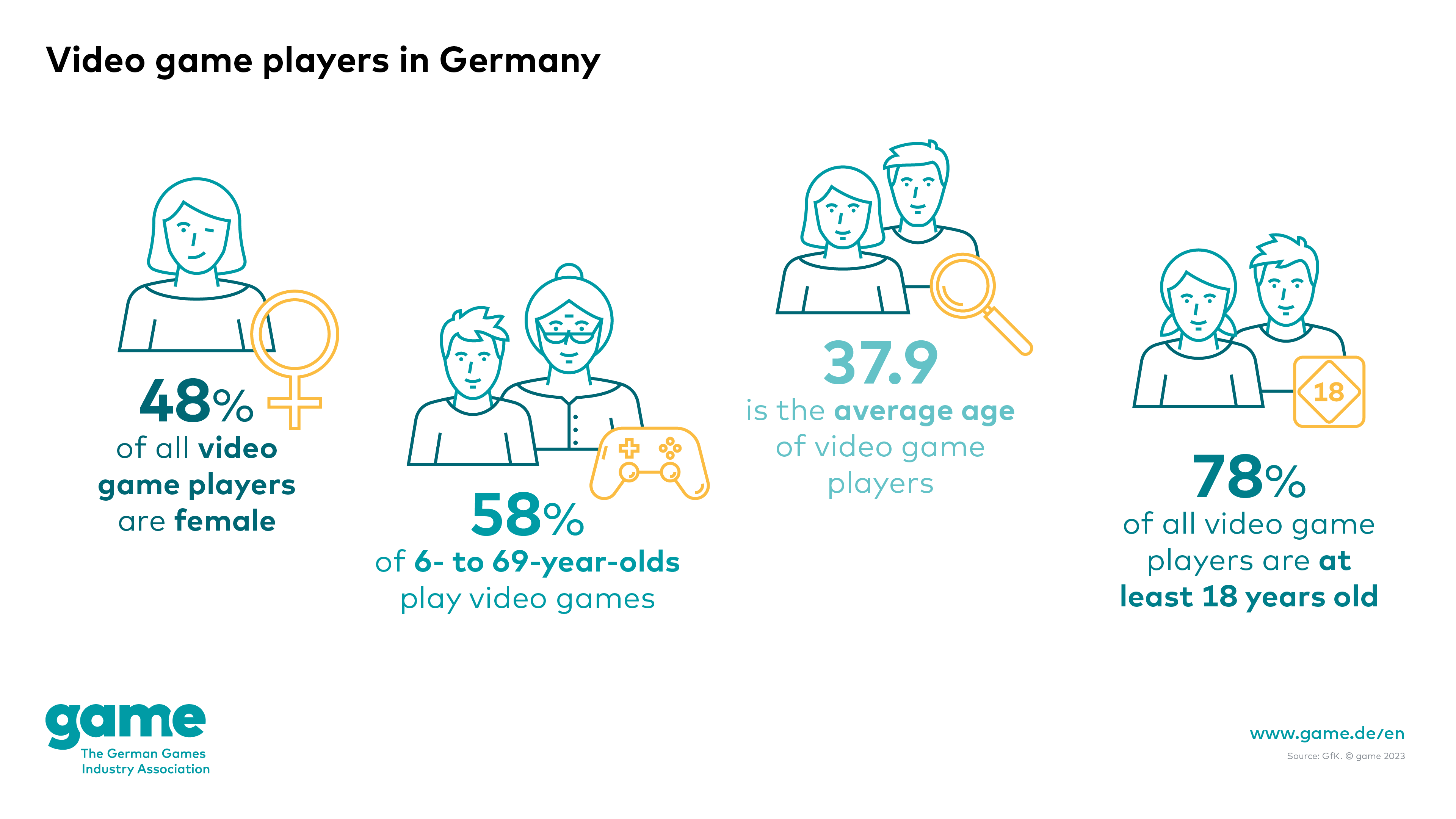

- Around six in ten Germans play video games – players’ average age increases to 37.9 years

- ‘The German games market was amazingly stable in 2022 despite various challenges.’

Following major increases in sales revenue in both 2020 and 2021, the German games market stabilised at a high level in 2022 – that was the conclusion offered by game – the German Games Industry Association when presenting the market data from surveys carried out by market research companies GfK and data.ai. Whereas the Covid-19 pandemic had resulted in annual growth of 32 per cent and 17 per cent respectively, in 2022 sales revenue generated by games, gaming hardware and charges for online services rose by an additional 1 per cent to 9.87 billion euros.

‘The German games market was amazingly stable in 2022 despite various challenges. Following the strong growth achieved in the wake of the Covid-19 pandemic, many people had expected sales revenue to decline in 2022, for example due to the high rate of inflation over the course of the year, the decline in time spent playing games, or the many games whose release dates had been postponed. In light of these circumstances, the 1 per cent growth achieved in 2022 is yet another sign of the industry’s success as the German games market manages to consolidate its gains near the ten-billion-euro mark,’ says Felix Falk, Managing Director of game – the German Games Industry Association.

Even the number of video game players has managed to stabilise at a high level following the growth achieved in the Covid-19 years: approximately six out of every ten people between the ages of six and 69 in Germany play games. There is also little difference according to gender, with women making up 48 per cent of video game players in Germany, and men 52 per cent. As has been the case in recent years, the average age once again rose slightly, and is now 37.9 years. In all, 78 per cent of players in Germany are at least 18 years old.

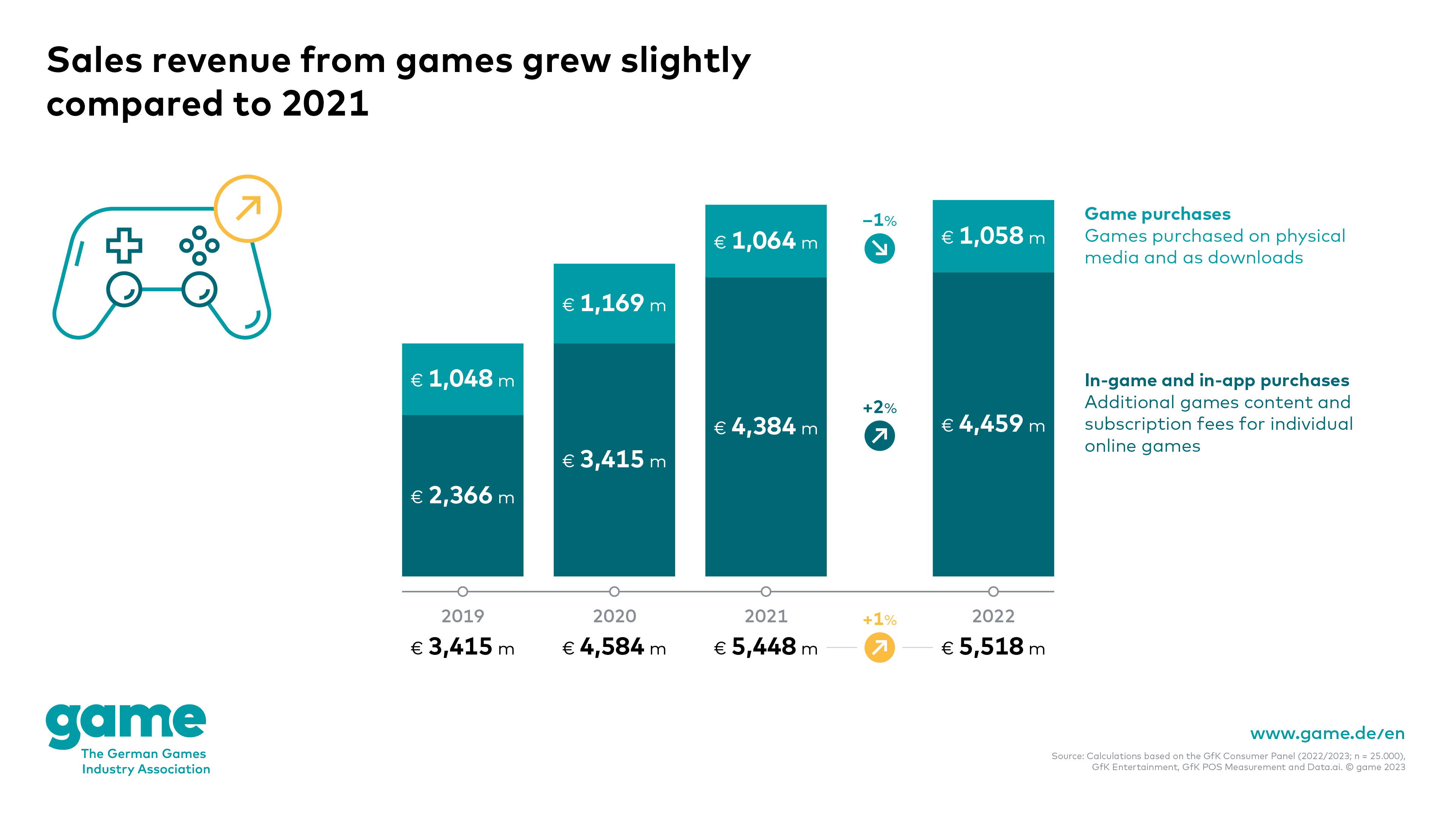

Sales revenue from online gaming services is growing, while demand for gaming hardware has declined somewhat

As with the market overall, the market segment devoted to games for PCs, game consoles and mobile devices has remained stable. For computer and video games (−1 per cent to approximately 1.1 billion euros) as well as in-game and in-app purchases (+2 per cent to approximately 4.5 billion euros), sales revenue figures were similar to last year’s. These include season passes, additional levels, cosmetic items (for example skins) and subscription fees for individual online games. In total, sales revenue from games for PCs, game consoles and mobile devices grew by roughly 1 per cent to 5.5 billion euros in 2022.

The online gaming services market segment experienced yet another year of strong growth, with sales revenue from these services increasing by 20 per cent to 866 million euros. Among the categories in this segment are fee-based subscription services that provide access to a large selection of games, cloud-based games, online multiplayer functions, and the ability to save game progress in the cloud. This market segment has enjoyed particularly dynamic growth. This is demonstrated not only by the large increase in sales revenue, but also by the wide range of gaming services on offer. Even though some large providers discontinued certain services last year, other services were expanded and revamped. As a result, numerous online gaming services have long since begun offering a range of functions – thereby rendering the old distinctions between online gaming services, subscription gaming services and cloud gaming services obsolete. Examples of these services include EA Play, Nintendo Switch Online, PlayStation Plus, Xbox Game Pass and Ubisoft+.

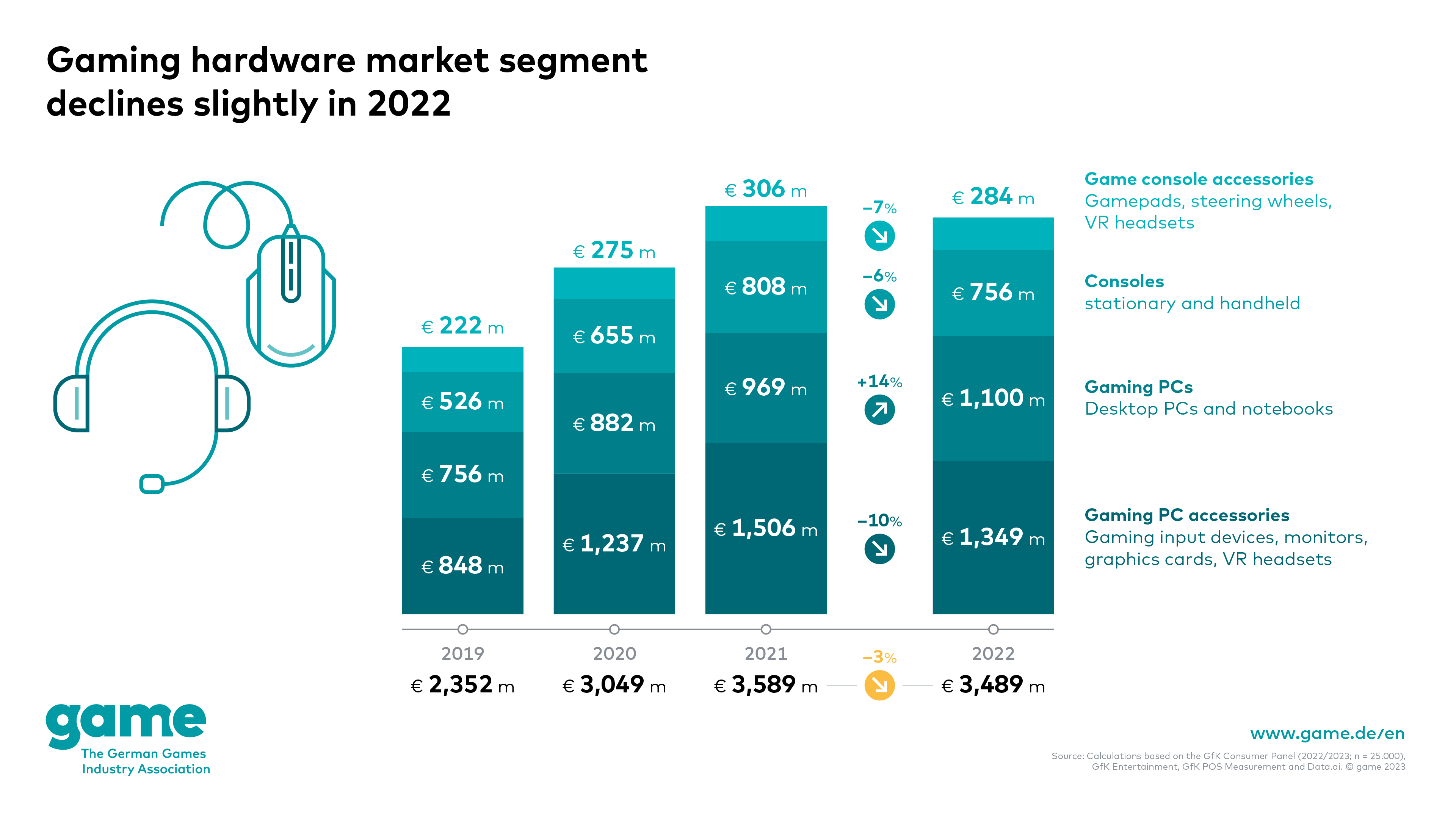

One of the most significant growth drivers in recent years has been gaming hardware, including gaming PCs, game consoles and the corresponding accessories. Following huge leaps in growth of 30 and 18 per cent in the past two years, 2022 saw this market segment decline slightly, by around 3 per cent to 3.5 billion euros. Reasons for this fall in revenues include the fact that game consoles like PlayStation 5 and Xbox Series X as well as the latest graphic cards were not available across the board. In addition, the major growth of the past two years means that numerous video game players already own the very latest gaming hardware.

About the market data

The market data is based on statistics compiled by the GfK Consumer Panel and data.ai. The methods used by GfK to collect data on Germany’s digital game market are unique in terms of both their quality and their global use. They include an ongoing survey of 25,000 consumers who are representative of the German population as a whole regarding their video game purchasing and usage habits, as well as a retail panel. The data collection methods provide a unique insight into the German market for computer and video games. As a result of numerous content overlaps between the individual games and services that had previously been divided into three categories (online gaming services, subscription gaming services and cloud gaming services), these are now for the first time being summarised under ‘online gaming services’. In addition, subscriptions for individual games have now been integrated into the in-game and in-app purchases submarket.

game – the German Games Industry Association

We are the association of the German game industry. Our members include developers, publishers and many other game industry actors such as esports event organisers, educational establishments and service providers. As a joint organiser of gamescom, we are responsible for the world’s biggest event for computer and video games. We are an expert partner for media and for political and social institutions, and answer questions relating to market development, game culture and media literacy. Our mission is to make Germany the best location for game development and production.

熱門頭條新聞

- Grand Prizes for “Beautiful Man” and “Memoir of a Snail” at Cinanima 2024

- FragPunk’s March 6th 2025 Release Date Revealed at The Game Awards

- Asfalia: Fear Debuts In January

- Nordic Game 2025: Good Things Ahead

- Battery Note+UNDERGROUNDED will release in 2025!

- Sugardew Island – Your Cozy Farm Shop Launches for PC and Consoles in March 2025!

- Multiplayer game Don’t Kill Rumble debuts with thrilling king of the hill action gameplay at The Latin American Games Showcase

- Submissions for MIAF 2025 are now OPEN.