D-BOX Technologies’ First Quarter Highlighted by Strong Growth in Revenue and Profitability

First quarter caps best four consecutive quarters on record

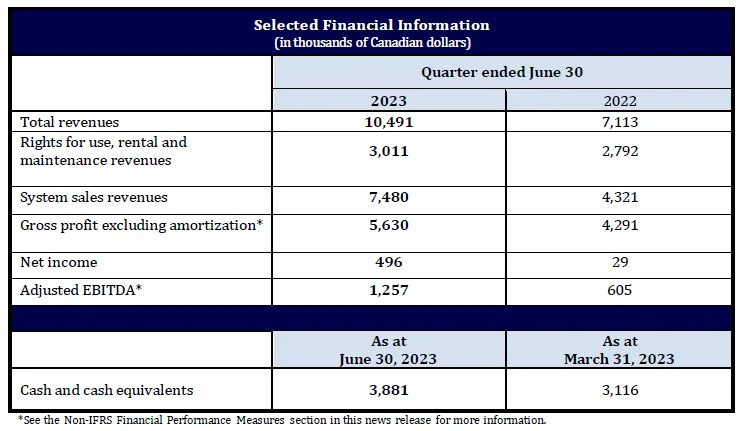

- Adjusted EBITDA* increased 108% to $1.3 million year-over-year

- Total revenues grew 47% to $10.5 million year-over-year

- System sales revenues increased 73% to $7.5 million year-over-year

- Rights for use, rental and maintenance revenues of $3.0 million – best on record

- Net income of $0.5 million, or $0.002 per share

D-BOX Technologies Inc. (“D-BOX” or the “Corporation”) (TSX: DBO) a world leader in haptic and immersive experiences, reported financial results for the first quarter ended June 30, 2023. All dollar amounts are expressed in Canadian currency.

“We continue to execute our plan for delivering profitable growth,” said Sébastien Mailhot, President and Chief Executive Officer of D BOX. “Following the strong revenue growth achieved in fiscal 2023, we are pleased to report our second-best quarter on record in terms of revenues, adjusted EBITDA, and net income. The first quarter was our strongest quarter yet for rights of use, rental and maintenance revenues. Moreover, our total revenue for the last four quarters amounted to $37.5 million, which is the highest for any four consecutive quarters in the history of D-BOX.”

“We are building momentum in multiple key markets. We continue to increase our footprint in theatrical, where our second quarter should benefit from the D-BOX releases of Barbie, Indiana Jones and the Dial of Destiny, Mission: Impossible – Dead Reckoning Part One, Gran Turismo, and others. We’re doing strong business in simulation and training, and gaining traction in racing / gaming, where we received initial revenues from the Motion 1 gaming chair during the quarter. Importantly, we see significant potential to grow our worldwide install base and industry-leading haptic ecosystem while delivering sustained profitable growth.”

D-BOX-Selected-Financial-Information_Q1-FY2024

FIRST QUARTER OVERVIEW

Revenue increased $3.4 million, or 47%, to $10.5 million compared with $7.1 million for the first quarter of last year. System sales grew by nearly $3.2 million, or 73%, driven by large increases in the entertainment and simulation and training markets. Simulation and training system sales increased by 153% to $2.9 million driven by growth in the transportation industry. Entertainment system sales increased by 44% to $4.5 million mostly due to expansion and growth in sim racing.

Rights for use, rental, and maintenance revenues reached a new quarterly record, increasing 8% to $3.0 million compared with $2.8 million for the same period last year. The growth was attributable to the Corporation’s increasing footprint in theaters, as well as a studio box office slate comparable to the same period last year.

Gross profit excluding amortization related to cost of goods sold increased to $5.6 million from $4.3 million for the first quarter of last year. Gross margin excluding amortization decreased to 54% from 60% a year ago due to a higher proportion (market mix) of system sales versus rights for use, rental and maintenance revenues compared to the same period last year. Rights for use, rental and maintenance revenues generate a higher margin than system sales.

Operating expenses for the quarter were $4.7 million, or 44.5% of revenues, compared to $3.8 million, or 53.7% of revenues in the first quarter of last year. The increase in operating expenses was mainly attributable to a $0.3 million increase in research and development expenses due to projects related to the next generation of actuator controllers and software development; a $0.2 million increase in selling and marketing expenses, due primarily to a $125 thousand reduction in government assistance during the period as compared to the same period last year; and a close to $0.3 million foreign exchange difference, driven by the volatility of the Canadian dollar relative to the U.S. currency between the periods. Marketing initiatives and participation in trade shows, business development events and travel focused on the entertainment and gaming markets also contributed to the increase in selling and marketing expenses.

Adjusted EBITDA increased 107.8% to $1.3 million from $0.6 million in the first quarter of last year. Net income was $496 thousand (basic and diluted profit of $0.002 per share) compared with $29 thousand (basic and diluted profit of $0.000 per share) for the same period last year.

On June 30, 2023, D-BOX had working capital of $9.0 million, including cash and cash equivalents of $3.9 million, compared to working capital of $8.4 million and cash and cash equivalents of $3.1 million as at March 31, 2023.

熱門頭條新聞

- Warner Bros. shuts down three game studios

- Rusty Rabbit: Free Demo Now Available for Nintendo Switch, PlayStation and PC/Steam

- Rusty Rabbit: Free Demo Now Available for Nintendo Switch, PlayStation and PC/Steam

- Soy Boy Games Unveils ‘Hex Blast’ Coming to PC in 2025

- ‘Yuck!’, ‘Flow’ Win 2025 French César Awards ceremony

- Animated film Ne Zha 2 is ‘China’s answer to Hollywood’ hegemony

- Mifa 2025 While Annecy Festival will pay tribute to Hungarian animation

- SUPERIGHTS TAPS JULIE FRAU AS NEW SALES COORDINATOR