AIB shipments rebound in Q4 2022, with unit sales climbing quarter to quarter

Quarter to- quarter, graphics add-in board shipments increased significantly, by 7.8%; however, shipments decreased by -27.4% year to year.

According to a new research report from the analyst firm Jon Peddie Research (JPR), unit shipments in the add-in board (AIB) market increased in Q4’22 from last quarter, while AMD gained market share. Quarter to quarter, graphics add-in board shipments increased significantly, by 7.8%; however, shipments decreased by -27.4% year to year.

Over $4.1 billion worth of AIBs shipped in the quarter, which represents an increase of $.04 billion from Q3’22.

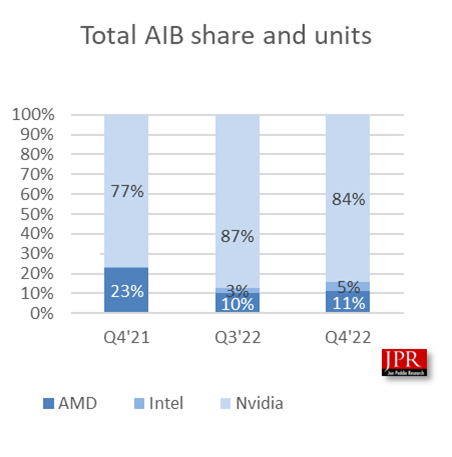

The market shares for the desktop discrete GPU suppliers shifted in the quarter, as AMD’s market share increased from last quarter and Nvidia increased share from last year. Intel, which entered the AIB market in Q3’22 with the Arc A770 and A750, will start to increase market share in 2023.

Market share changes quarter to quarter and year to year.

Quick Highlights

JPR found that AIB shipments during the quarter increased from the last quarter by 7.8%, which is above the 10-year average of -2.8%.

Total AIB shipments decreased by -27.4% this quarter from last year to 7.3 million units, and yet increased from 6.81 million units from last quarter.

AMD’s quarter-to-quarter total desktop AIB unit shipments increased 21.2% and decreased -62.2% from last year.

Nvidia’s quarter-to-quarter unit shipments increased 4.0% and decreased -22.0% from last year. Nvidia continues to hold a dominant market share position at 84.1%.

AIB shipments from year to year decreased by -27.4% compared to last year.

“The fourth quarter of 2022 was peculiar in terms of AIB shipments, as some last-gen product inventory levels were being run down while new ones were introduced, combined with excess inventory and overhang in the channel. Some products like Nvidia’s RTX 4090 did exceptionally well despite its high price, so almost everything we thought we knew about economics and market behavior seemed to be turned on its head in Q4,” said Dr. Jon Peddie, president of JPR.

- Robert Dow, analyst at JPR, noted, “We saw a modest return to growth in Q4 2022 due to the stabilization of AIB prices and the successful rollout of next-generation GPUs from AMD and Nvidia. The high-end RTX 4090, priced at $1,599 at launch, was particularly successful, with retailers unable to keep the part in stock. The success of these high-end AIBs reflects that first adopters are becoming acclimated to higher prices.”

JPR has been tracking AIB shipments quarterly since 1987—the volume of those boards peaked in 1998, reaching 116 million units. The AIB market reached $24,143.3 billion in the last four quarters. JPR forecasts the AIB market to grow by 7% over the next three years.

Pricing and availability

Jon Peddie Research’s AIB Report is now available and sells for $3,000. The annual subscription price for JPR’s AIB Report is $6,000 and includes four quarterly issues and four hours of consulting. Subscribers to JPR’s TechWatch are eligible for a 10% discount. Bundled packages are also available. For information about purchasing the AIB Report, please call (415) 435-9368 or visit the Jon Peddie Research website at http://www.jonpeddie.com/.

About Jon Peddie Research

Jon Peddie Research has been active in the graphics and multimedia fields for more than 30 years. JPR is a technically oriented multimedia and graphics research and consulting firm. Based in Tiburon, California, JPR provides consulting, research, and other specialized services to technology companies in a variety of fields including, graphics development, multimedia for professional applications and consumer electronics, high-end computing, and Internet-access product development. JPR’s Market Watch is a quarterly report focused on PC graphics controllers’ market activity for notebook and desktop computing.

熱門頭條新聞

- The AI Agent operating system has raised $56 million in funding.

- AIGC industry development status in China

- Ventana Sur 2024: Official Selection

- Infinity Nikki hits 30 million pre-registrations ahead of launch later this year

- UNCLE CHOPS ROCKET SHOP LAUNCHES NEXT MONTH

- Industry legend Peter Molyneux joins NG25 Spring

- Lexar Introduces Professional Workflow 6-Bay Docking Station, Workflow Portable SSD, Workflow Reader Modules, and Three CFexpress 4.0 Cards

- The Next Generation Soul Game is Officially Released!