What Happens to Games after the Version Number Approval is Restarted

On January 9, 2019, the official website of the State Administration of Press, Publication, Radio, Film and Television released the information on the approval of domestic online games in December 2018.

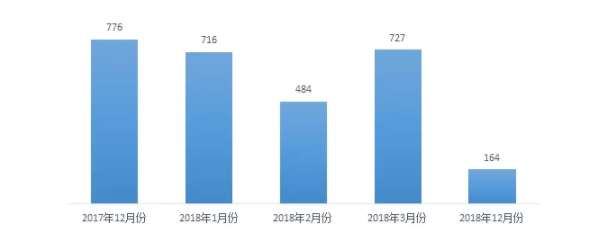

As the first announcement of the game version number approval since the restart, the total number of games approved this time is 164. Before the end of the 2018 review in March 2018, the game version number was basically maintained at around 675 per month.

Before the comparison of the version number approval, the amount of games approved through the examination was greatly reduced. Compared with December 2017, it fell by 77.7%. After the 8 months of approval of the version number, the SARFT issued a cautious and slow-moving attitude towards the game version.

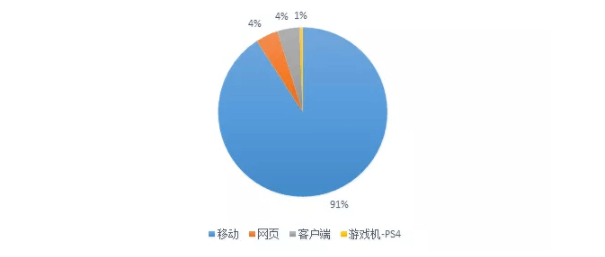

Mobile games are still the mainstream of the current game industry. In the games approved by this review, mobile games accounted for 90.9%, and web and client games accounted for only 8.54%.

Host game is still the disadvantage of China’s game industry. In the information released in December 2017, there were only 2 PS4 games; in January and February of 2018, there was no host game review; in March 2018, there were only 4 PS4 games.

Due to the particularity of the game development process in China and the restrictions of the policy, most domestic players are directly in the game, and they skip the game console game and the console game, so that the host game is higher in the production level and the game quality. The game, but still can not be popularized in the country.

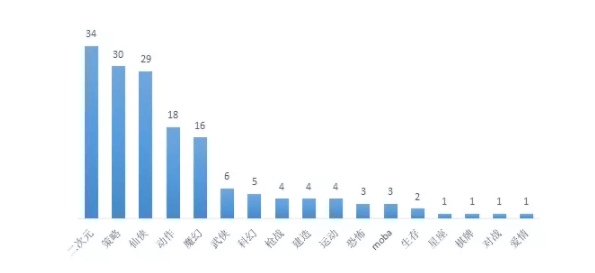

Games with secondary meta tags have the highest proportion of all over-the-counter games; strategy games rank second; followed by Xian Xia, action, magic, martial arts, etc.

In this 164 over-the-counter game, there are 62 models in the game name including “Xian, Xia, Devil, God, Eternal, Sword, Wu, Heaven, Legend, Life, You, St., Spirit, Comprehension, Love”. 37.8% of the volume; there are 17 models including “Hegemony, Defence, Kingdom, War, Disputes, Competition, Imperial City, World”, accounting for 10.4% of the total; 8 of them include “Three Kingdoms, Three Footballs”, accounting for The total amount is 4.88%; only one paragraph containing “chess”.

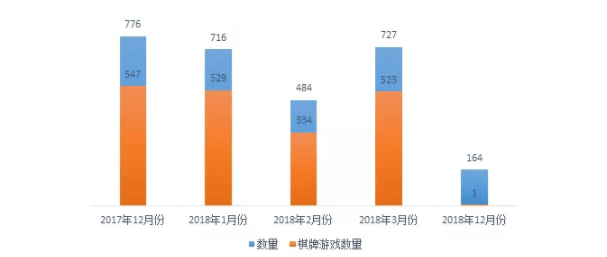

Although there are still a large number of mobile games that are known as shoddy, it is fortunate that the number of chess games has been greatly reduced.

In December 2017, chess games accounted for 70.49% of the total number of games reviewed in the month. In January 2018, chess games accounted for 73.88% of the total number of games reviewed in the month. In February 2018, chess games accounted for the total number of games reviewed in the month. 69.01%, in March 2018, chess games accounted for 71.94% of the total number of games reviewed in the month. In December 2018, chess games accounted for only 0.61% of the total number of games reviewed in the month.

The reason why chess and card games are flooded, the reason is nothing more than: First, the development difficulty is low; Second, the profitability is strong; and gambling, in the game interface is put a few “beauty dealers”, gambling nature and sex Under the dual effect, chess and card games are popular in 34-line cities and rural areas. This chess game has only passed one trial, and we can see the country’s determination to rectify chess games.

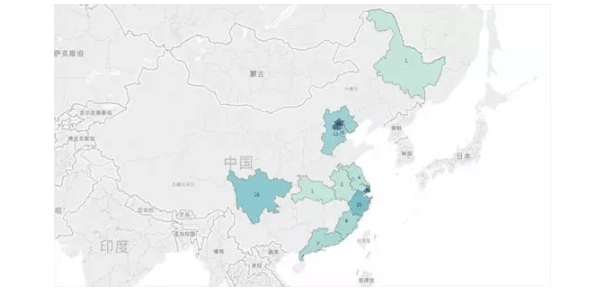

The geographical distribution of R&D companies is mainly concentrated in the southeastern coastal areas, followed by the surrounding provinces of Beijing and Beijing, while the inland areas are concentrated in Sichuan Province. The top three are Beijing, Shanghai and Zhejiang. On the whole, it shows that the south is strong and the north is weak, and the east is strong and the west is weak.

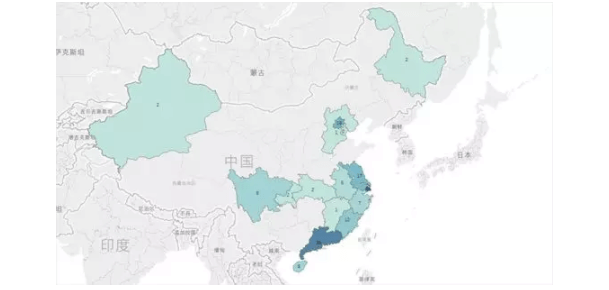

In contrast, operating companies have a wider geographical distribution, but they are still concentrated in the southeastern coastal areas, Beijing and neighboring provinces of Beijing. Sichuan Province is the only province in the inland province with more game development companies and operating companies. This is also closely related to the cultural policy of Sichuan Province.

The geographical distribution of operating companies has a more southerly trend. Guangdong is the province with the largest number of game operators, followed by Beijing and Shanghai. The difference between the number of operating companies owned by these two places and other provinces is not large.

In addition, except for municipalities, most game research and development companies and operating companies are still concentrated in provincial capital cities, such as Hangzhou, Zhejiang, Chengdu, Sichuan, Shijiazhuang, Heilongjiang, Hefei, Anhui. Fujian and Guangdong are among the few “dual-core” provinces, Fuzhou and Xiamen in Fujian, Guangzhou and Shenzhen in Guangdong.

Transfer from: WeChat public number “IP industry and research”

熱門頭條新聞

- Industry legend Peter Molyneux joins NG25 Spring

- Lexar Introduces Professional Workflow 6-Bay Docking Station, Workflow Portable SSD, Workflow Reader Modules, and Three CFexpress 4.0 Cards

- The Next Generation Soul Game is Officially Released!

- QUERN DEVELOPERS JOIN FORCES WITH BLUE BRAIN GAMES FOR MYSTERIOUS NEW ADVENTURE DIMHAVEN ENIGMAS

- Announcing FMX 2025: Rhythm of Change

- Detective Mystery Game Detective Dotson Announces Animated Film

- DISCOVER WHAT LIES BEYOND THE DOORS OF THE SOMNIUM LABYRINTH IN WUTHERING WAVES UPDATE WHEN THE NIGHT KNOCKS COMING SOON

- The global GPU market is worth almost $100 billion.