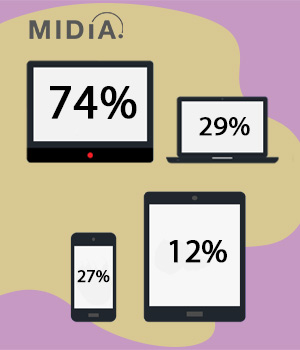

TV Content Consumption by device in Q4 2020

TV still remains the dominant device for viewing long-form video content i.e. TV shows and movies. However, after a year like no other…

TV still remains the dominant device for viewing long-form video content i.e. TV shows and movies. However, after a year like no other…

Has TV content consumption by device evolved during 2020?

2020 was the year when the future arrived for TV and film. The trend towards streaming had dramatically shifted as the combination of newly launched direct-to-consumer propositions and rolling global lockdowns to combat the COVID-19 pandemic, resulted in streaming becoming mainstream. While broadcast TV experienced increased engagement during lockdown, the long trend has been a significant decline in linear TV viewing which has partially been facilitated by a switch to non-TV devices. However, the TV still remains the dominant device for viewing long-form video content i.e. TV shows and movies.

The TV remains the preeminent video viewing device: The TV device has taken a noticeable hit in its central role as the go-to device for video viewing among households. In Q1 2020, 88% of US consumers watched TV and film content on the TV. In Q4 2020, this had declined to 74%. Meanwhile viewing TV content on tablets and computers both slightly increased over the same period. Noticeably, phone viewing actually declined over the same period of time. This suggests that the long-held industry fear of mobile-viewing coming to dominate TV consumption is unlikely to pass, due to fundamental viewing advantages of the TV device (shared communal viewing, large screens, remote controls, audio visual enhancement etc.) The TV is set up first and foremost as a long-form video consumption device. A smart phone is primarily a communications tool, and secondarily an entertainment destination tool. However, the role of the TV as the default device for video content consumption is slowly being decoupled as streaming increasingly becomes normalised among mainstream consumers.

TV content device consumption is gender-nuanced: How and where viewers consume TV content is impacted by gender and age. Females for example under-index for all non-TV set device viewing, but over-index slightly for viewing TV content on a TV (89% penetration). While these gender variances are relatively minor in absolute terms (33% of male consumers view TV content on the computer versus 27% for females for example) they are more dramatic in more niche activity such as game console viewing, where 17% of males engage, while only 10% of females carry out the same activity. Even areas of recent particular interest to the TV industry such as multiple screen viewing is skewed towards males (6% for males, versus 4% for females.) The key takeaway is that female audiences are currently slightly more inclined towards TV-set consumption than male audiences.

TV content device viewing is heavily impacted by age: The less traditional the TV content viewing device, the more youth-skewed are the demographics behind its consumption. A case in point is games console viewing of TV content, where 16-19 year olds make up 12% of all the consumers engaged in this activity, while 55+ year olds only make up 3% of the segment. When considering demographic penetration (the percentage of each age group who engage in the activity), 30% of all 16-19 year olds watch TV content on games consoles, but only 1% of 55+s do so. Flip the focus to TV set consumption and the 55+s make up a third of all consumers who watch TV shows and movies this way, with 16-19 year olds only making up 6% of these consumers. However, penetration engagement is closer with 72% of 16-19 year olds, and a massive 96% of 55+s watching long-form content on a TV set.

Why this matters – TV content consumption by device

While device viewing is more fragmented than at any time in the history of TV, with demographic nuances defining the extent of this dispersal of the TV content audience, the TV set remains the anchor device for now. Nothing has yet supplanted the TV set viewing experience for watching TV content. However, as we move into a post-linear scheduling world, and as TV content becomes just one strand of an increasingly diverse digital media landscape, the primacy of the TV set will inevitably continue to decline. We are still some way from that eventuality, but with future generations of adult consumers now streaming D2C natives, the future will be one of increasing digital commodification of the TV experience.

Source: MIPtrend

熱門頭條新聞

- In conversation with ‘Ultraman Rising’ director Shannon Tindle: Insights on storytelling, innovation, and collaboration in animation

- Breaking Free: Disney Declares Independence from the Apple App Store

- Warner Bros Discovery confirms Max launch in seven Asian markets

- A look at the winners of the 72nd San Sebastian International Film Festival

- Talpa Studios and Hasbro Entertainment showcased Trivial Pursuit at MIPCOM 2024

- NARAKA: BLADEPOINT Invites You to Dance with the Spirits

- Curve Games Signs Publishing Agreement with Patattie Games for Upcoming Title Wax Heads

- DUBAI STUDIOS SIGNS PARTNERSHIP WITH INTERNATIONAL ACADEMY OF TELEVISION ARTS & SCIENCES