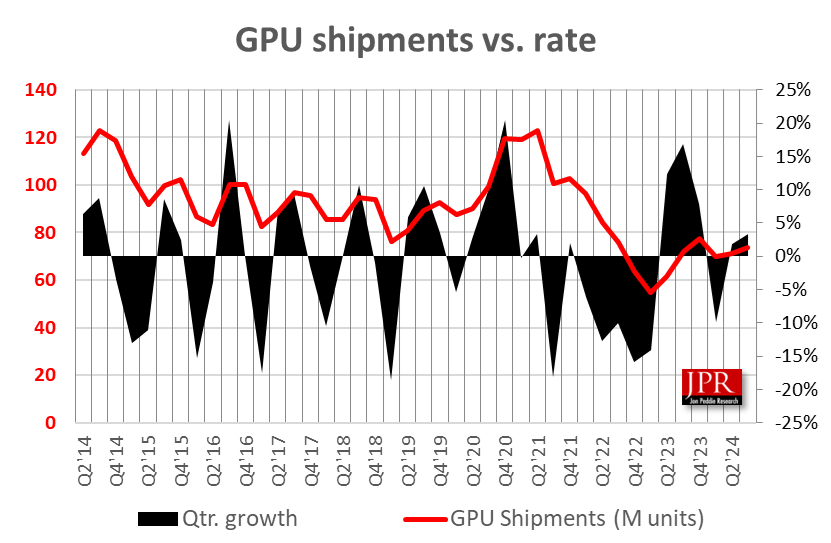

Third-quarter GPU shipments were up 3.4%. Is seasonality returning?

Data center GPUs were up an average of 1.7% from last quarter.

Jon Peddie Research reports that the growth of the global PC-based graphics processor unit (GPU) market reached 73.6 million units in Q3’24, and PC CPU shipments increased to 66.5 million units.

Overall, GPUs will have a compound annual growth rate of -1.9% from 2025 to 2028 and reach an installed base of almost 3 billion units at the end of the forecast period. Over the next four years, the penetration of discrete GPUs (dGPUs) in PCs will be 17%.

Figure 1. GPU shipments for the quarter increased by 3.4% and by 2.4% year over year.

Year-to-year total GPU shipments, including all platforms and types of GPUs, increased by 2.4%, desktop graphics decreased by -5.6%, and notebooks increased by 5.9%.

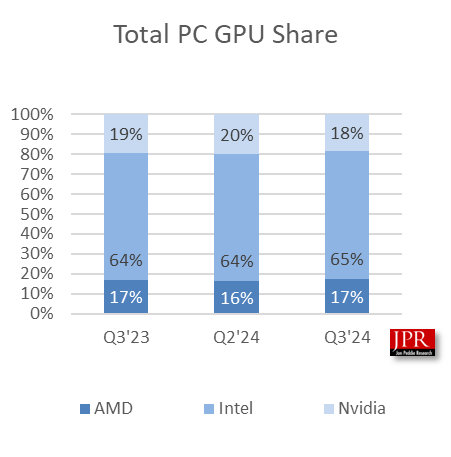

As indicated in the following chart, AMD’s overall GPU market share increased by 0.8% from last quarter, Intel’s market share rose by 1.1%, and Nvidia’s market share decreased by -1.9%.

Figure 2. Quarterly market share percentages based on millions of units.

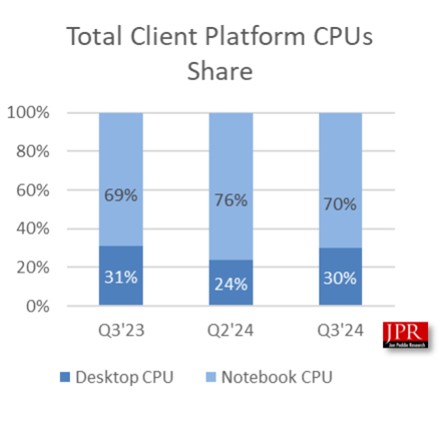

Overall, CPU unit shipments increased by 12% from last quarter; AMD’s increased by 15%, and Intel’s decreased by -12%.

The GPU’s overall attach rate (which includes integrated and discrete GPUs, desktops, notebooks, and workstations) in PCs for the quarter dropped to 111%, down -9.5% from last quarter.

The overall PC CPU market increased by 7.8% year to year and 12% quarter to quarter.

Figure 3. CPU shipments by platform share.

The third quarter is traditionally higher than the previous quarter. This quarter’s GPU shipments were up from the previous quarter and below the 10-year average of 6.2%.

“A surge led to the jump in overall GPU and CPU shipments in Q3,” said Dr. Jon Peddie, president of Jon Peddie Research. “AMD and Intel released new CPUs, and there was some pent-up demand for them. However, looking forward, we think that if the proposed tariffs are imposed, the PC market will suffer a recession due to increased prices and unmatched increases in income.”

GPUs and CPUs are leading indicators of the PC market because they go into a system while it’s being built, before the suppliers ship the PC. However, most semiconductor vendors are guiding up for the next quarter an average of 7.6%. Last quarter, they guided -7.9%, which was too low. The 10-year average for Q2-to-Q3 shipments is 0.9%, so happy days may not be entirely here just yet, but given the turmoil, it’s hard to predict.

The new Q3’24 edition of Market Watch contains the above information and more. For easier consumption, we have changed the report’s format from a heavily narrated version to a heavily charted version. We have also added server and client CPU shipment data back to Q1’21 and GPU-compute (which includes AI GPUs) shipment data back to Q1’21 for AMD, Intel, and Nvidia. We have expanded the pivot data array to include those devices.

JPR also publishes a series of reports on the graphics add-in board market the PC gaming hardware market, the workstation market, the CAD, and content creation markets, and other related market studies.

About Jon Peddie Research

Jon Peddie Research has been active in the graphics and multimedia fields for more than 30 years. JPR is a technically oriented multimedia and graphics research and consulting firm. Based in Tiburon, California, JPR provides consulting, research, and other specialized services to technology companies in various fields, including graphics development, multimedia for professional applications and consumer electronics, high-end computing, and Internet-access product development. JPR’s Market Watch is a quarterly report focused on PC graphics controller’s market activity for notebook and desktop computing.

熱門頭條新聞

- SIGGRAPH 2025: Innovation and Community Meet in the Heart of Vancouver

- Third-quarter GPU shipments were up 3.4%. Is seasonality returning?

- Cinesite expands XR capabilities with Adipat Virdi

- AMPAS Announces All Animated, Documentary & International Films Eligible For The 97th Academy Awards

- Government-funded Houdini bootcamps to upskill VFX and animation teams

- NG25 Spring: Important times and dates

- Dino-Ducks Dash Is Dashing Onto Steam On December 16th!

- Puella Magi Madoka Magica Magia Exedra – Pre-Registrations Are Now Open On All Platforms!