PC GPU shipments increased by 11.6% sequentially from last quarter

PC GPU shipments increased by 11.6% sequentially from last quarter and decreased by -27% year to year.

The second quarter is normally down, could this signal a recovery?

Jon Peddie Research reports the growth of the global PC-based graphics processor unit (GPU) market reached 61.6 million units in Q2’23 and PC CPU shipments decreased by -23% year over year. Overall, GPUs will have a compound annual growth rate of 3.70% during 2022–2026 and reach an installed base of 2,998 million units at the end of the forecast period. Over the next five years, the penetration of discrete GPUs (dGPUs) in the PC will grow to reach a level of 32%.

Year to year, total GPU shipments, which include all platforms and all types of GPUs, decreased by -27%, desktop graphics decreased by -36%, and notebooks decreased by -23%.

However, in a quarter that is traditionally down, quarter-to-quarter shipments had a significant increase in shipments. OEMs and the channel took more GPUs and add-in boards than normal, indicating the old inventory is gone and demand is high, despite Web mutterings about AIBs being overpriced.

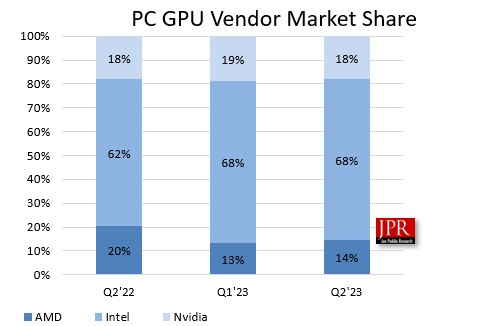

AMD’s overall market share increased 1.2% from the last quarter, Intel’s market share decreased by -0.4%, and Nvidia’s market share decreased by -0.8%, as indicated in the following chart.

Figure 1: Quarterly shipments, market share percentages, and year-to-year results.

Overall, GPU unit shipments increased by 12.4% from last quarter, AMD’s shipments increased 22.9%, Intel’s shipments rose 11.7%, and Nvidia’s shipments increased 7.5%.

Quick highlights

The GPU’s overall attach rate (which includes integrated and discrete GPUs, desktops, notebooks, and workstations) to PCs for the quarter was 115%, down -2.6% from last quarter.

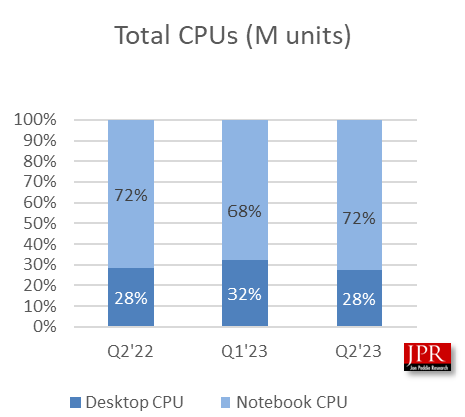

The overall PC CPU market increased by 15.0% quarter to quarter and decreased -23.0% year to year.

Desktop graphics add-in boards (AIBs that use discrete GPUs) increased by 2.9% from the last quarter

This quarter saw -31.9% change in tablet shipments from last quarter.

Figure 2: CPU shipments by platform share and units.

The second quarter is typically down compared to the previous quarter. This quarter was up 12.4% from last quarter, which is above the 10-year average of 8.1%.

GPUs have been a leading indicator of the market because a GPU goes into a system before the suppliers ship the PC. Most of the semiconductor vendors are guiding up for the next quarter an average of 9.8%. Last quarter, they guided 15.3%, which was too high.

Jon Peddie, president of JPR, noted, “Q2 was surprisingly up, significantly up, led by AMD in growth and by Nvidia in total shipments. Nvidia had their best results in notebooks, AMD did well in desktops, and Intel had year-to-year overall growth. The suppliers are bullish and expecting a strong third quarter, which is normal—if things will ever be normal again.

“Whereas the increased shipments are welcome good news, the overall PC market and, therefore, the GPU market, has been on a steady decline since 2010. And so, if the market has indeed turned around, it’s not going to get to the levels it was 10 years ago.”

The above information and more can be found in the new Q2’23 edition of Market Watch. We have changed the format of the report from a heavily narrated version to a heavily charted version for easier consumption. Also, we have added server and client CPU shipment data back to Q1’21 and GPU-compute (GPGPU) shipment data back to Q1’21 for AMD, Intel, and Nvidia. We have expanded the pivot data array to include those devices.

Pricing and availability

JPR’s Market Watch is available in electronic and hard-copy editions, and a single issue sells for $3,000. This report includes an Excel workbook with the data used to create the charts, the charts themselves, and supplemental information. The annual subscription price for JPR’s Market Watch is $6,000 and includes four quarterly issues. Full subscribers to JPR services receive TechWatch (the company’s exclusive access to daily news).

Contact Robert Dow at JPR (robert@jonpeddie.com) for a free sample of TechWatch.

About Jon Peddie Research

Jon Peddie Research has been active in the graphics and multimedia fields for more than 30 years. JPR is a technically oriented multimedia and graphics research and consulting firm. Based in Tiburon, California, JPR provides consulting, research, and other specialized services to technology companies in various fields, including graphics development, multimedia for professional applications and consumer electronics, high-end computing, and Internet-access product development. JPR’s Market Watch is a quarterly report focused on PC graphics controllers’ market activity for notebook and desktop computing.

source:JPR

熱門頭條新聞

- Nordic Game 2025: Good Things Ahead

- Battery Note+UNDERGROUNDED will release in 2025!

- Sugardew Island – Your Cozy Farm Shop Launches for PC and Consoles in March 2025!

- Multiplayer game Don’t Kill Rumble debuts with thrilling king of the hill action gameplay at The Latin American Games Showcase

- Submissions for MIAF 2025 are now OPEN.

- Announcing ! From the creators of Core Keeper

- Mobile Legends:M7 World Championship set for January 2026

- Submission deadline extended!