Breaking Free: Disney Declares Independence from the Apple App Store

Disney is breaking up with Apple — at least a little bit.

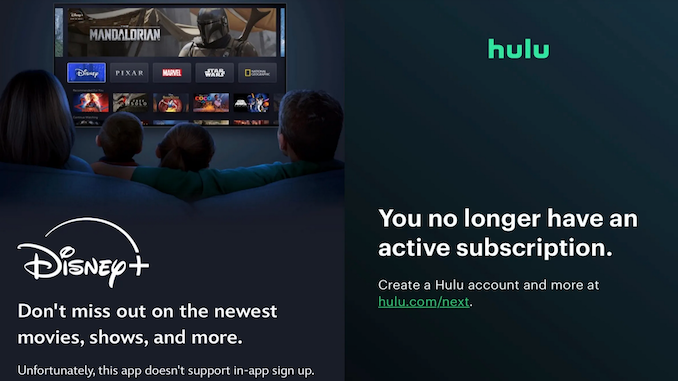

Disney is no longer letting new customers sign up for Hulu or Disney+ via Apple’s App Store.

The move comes after Disney CEO Bob Iger complained about app-store fees.

In a bold move to reclaim control over streaming revenue, Disney has severed its dependency on Apple’s App Store for new subscriptions to Disney+ and Hulu. This decision echoes similar actions from Netflix and signifies an emerging financial strategy and a broader power dynamics shift between content providers and tech platforms.

With Disney’s streaming profitability under the microscope, the change hints at a more significant transformation in how major players approach digital content monetization.

Breaking Free from Apple’s Revenue Cut

Disney’s departure from Apple’s App Store billing system is primarily driven by economics. Apple takes a significant cut from in-app purchases — 30% in the first year, dropping to 15% in subsequent years. In an era of rising streaming costs and subscriber churn, Disney’s choice to redirect new customers to its own website allows the company to reclaim this revenue, bypassing Apple’s toll. Given Disney’s recent focus on profitability within its streaming segment, this move aligns with a broader strategy to protect every dollar generated from subscription fees.

The shift is not unique to Disney. Netflix implemented a similar policy in 2018, steering subscribers to sign up outside Apple’s ecosystem. By following suit, Disney not only safeguards its subscription revenue but also positions itself to refine its direct-to-consumer relationship further.

Existing Apple-billed subscribers remain unaffected for now, yet this pivot redefines how Disney balances partnerships with platforms and its need for control over revenue streams.

How Streaming Titans Are Redefining Platform Partnerships

Disney’s strategic maneuver also underscores a power shift in the streaming landscape, where content creators are increasingly less willing to yield control — or profit shares — to tech giants like Apple. While Apple has attempted to leverage its App Store and Apple TV platform as aggregators for streaming services, the company’s success relies on hosting a diverse portfolio of subscription options. Disney’s departure from this model dents Apple’s streaming ambitions and further levels the playing field for content providers and tech platforms.

This trend has broader implications as companies like Amazon and Google, which also operate subscription marketplaces, confront similar decisions from streaming titans. As more providers reconsider the cost-benefit of relying on external platforms, tech companies face an increasingly difficult task of maintaining a robust and varied selection of streaming services.

The Rising Importance of Direct Revenue Channels

By directing subscribers to its own platform, Disney reinforces a shift toward direct revenue channels, allowing it to retain more control over the subscriber experience. Beyond significant financial savings, this strategy offers Disney greater flexibility in offering exclusive promotions, personalized recommendations, and custom user experiences that are or will be limited or restricted within the App Store ecosystem.

This autonomy becomes even more crucial as Disney and others experiment with subscription pricing, ad-supported models, and account-sharing crackdowns. Disney has already increased prices for both Disney+ and Hulu, illustrating the need to manage its streaming offerings independently. Moreover, Disney’s tighter control over account setups can enable more nuanced enforcement of password-sharing policies — an area of growing concern across the streaming industry.

Streaming Aggregation: A Fragmented Future?

Apple’s role as a subscription aggregator also takes a hit from Disney’s exit. Disney weakens Apple’s position as a convenient one-stop shop for premium streaming subscriptions by drawing users away from the App Store. This could mean a decline in its 15% market share of premium SVOD subscriptions for Apple, especially with Disney’s influence in the entertainment landscape.

For users, this development may translate to less seamless integration of Disney+ and Hulu within Apple’s platform, as Disney’s services become ineligible for Apple’s Video Partner Program. This program’s perks — including Siri integration, AirPlay support, and universal search — may be restricted, potentially diminishing the user experience on Apple devices.

However, the broader question remains: if other platforms, particularly Amazon’s Prime Video Channels, see a similar exodus, the landscape of streaming aggregation might splinter further. Rather than accessing multiple services within one interface, users may increasingly have to navigate distinct apps and billing systems, complicating the convenience factor once promised by aggregation. The move towards aggregation and bundling may stall at the starting line.

Disney’s Timing: Why Now?

Disney’s timing for this shift coincides with its delicate balance of expanding profitability and sustaining growth. Following its recent price hikes and a robust anti-password-sharing stance, Disney is making decisive moves to optimize its streaming performance.

The next earnings report in November will be crucial in assessing how these strategies impact Disney’s bottom line, especially as the industry anticipates the potential for further adjustments in content and service pricing.

The decision also arrives as Apple grapples with antitrust challenges regarding its App Store policies. Amid this regulatory scrutiny, Disney’s exit is a public challenge to Apple’s revenue-sharing practices, potentially encouraging other companies to reassess their relationships with the platform. This ongoing tension between tech and content giants points to a future where content providers are increasingly unwilling to accommodate platform fees that undermine their own profitability.

熱門頭條新聞

- How will multimodal AI change the world?

- Moana 2

- AI in the Workplace

- Challenging Amazon: Walmart’s Vision for the Future of Subscription Streaming

- LAUNCH OF AN UNPRECEDENTED ALLIANCE BETWEEN EUROPEAN FILM AND AUDIOVISUAL MARKETS

- Marvel Rivals Unveils Launch Trailer

- The Studio Park Thailand: A Pemier Production Hub for Southeast Asia

- ABC Commercial partners with Amagi to launch suite of FAST channels