The post-Covid black death is over

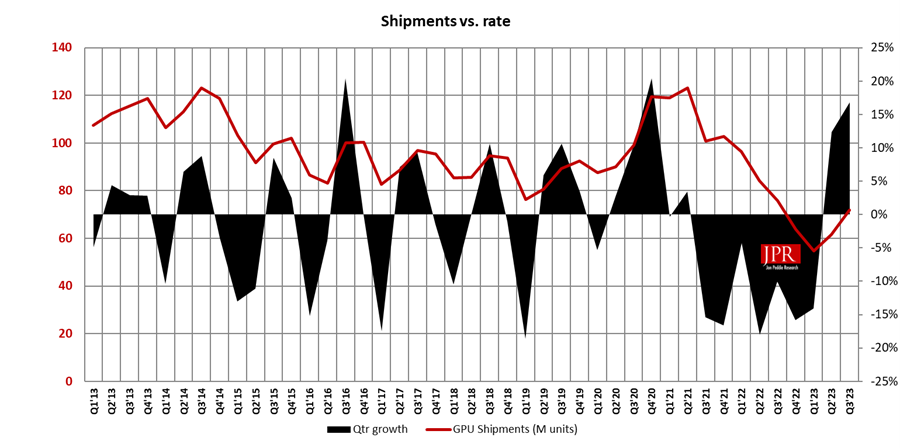

PC GPU shipments increased by a whopping 16.8% from last quarter and decreased a mild -5% year to year.

Jon Peddie Research reports the growth of the global PC-based graphics processor unit (GPU) market reached 71.9 million units in Q3’23 and PC CPU shipments decreased by -5.1% year over year, the lowest year-to-year decline in half a decade. Overall, GPUs will have a compound annual growth rate of 4.18% during 2022–2026 and reach an installed base of almost 5 billion units at the end of the forecast period. Over the next five years, the penetration of discrete GPUs (dGPU) in the PC will be 30%.

Figure 1. Two consecutive quarters of growth put the GPU market back in traditional seasonal sync.

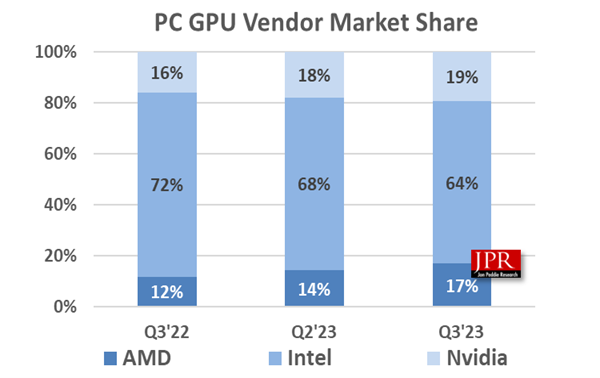

Market share shifted drastically due to iGPUs

AMD’s overall market share increased 2.4% from last quarter, Intel’s market share decreased by -3.7%, and Nvidia’s market share increased 1.30%, as indicated in the following chart.

Figure 2. Quarterly shipments, market share percentages, and year-to-year results.

Overall, GPU unit shipments increased by 16.8% from last quarter. AMD’s shipments increased 36.6%, Intel’s shipments rose 10.4%, and Nvidia’s shipments increased 25.2%.

The GPU’s overall attach rate (which includes integrated and discrete GPUs, desktops, notebooks, and workstations) in PCs for the quarter was 117%, up 1.6% from last quarter.

Desktop graphics add-in boards (AIBs that use discrete GPUs) increased by 37.4% from the last quarter

This quarter saw 6.1% change in tablet shipments from last quarter.

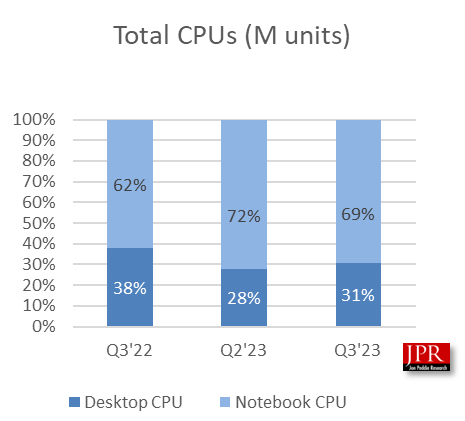

The overall PC CPU market increased by 15.2% quarter to quarter and decreased -6.0% year to year.

Figure 3. CPU shipments by platform share and units.

The third quarter typically has the strongest growth compared to the previous quarter. Not only was this quarter up 16.8% from the last quarter, but it was also almost double the 10-year average of 8.8%.

“The GPU and PC market have had some violent roller-coaster rides over time: the crypto mining swing, the 2008 recession, the Covid shutdown,” said Dr. Jon Peddie, president of Jon Peddie Research. “All of them brought the PC market down a notch, and always the market rebounded, but not quite as high as before. And every time, overenthusiastic forecasters tried to read into it their fantasies and desires. This bounceback is no different and is being overpraised, when it largely reflects a cleaning out and straightening up of the distribution channel. All through the last three quarters, add-in boards sold, not at the normal volumes, and albeit with complaints about prices, but sold, nonetheless. The mistake is the constant search for sensationalism. It’s fatiguing.”

GPUs have been a leading indicator of the PC market because a GPU goes into a system while it’s being built, before the suppliers ship the PC. However, most of the semiconductor vendors are guiding down for the next quarter an average of -4.9%. Last quarter, they guided 7%, which was too low. The 10-year average for Q3-to-Q4 shipments is 0.9%, so happy days may not be completely here just yet. However, some organizations’ reading of the tea leaves see the two consecutive quarters of growth as the harbinger of a fantastic 2024, just like they saw the Covid demand for Chromebooks as the beginning of an explosive demand for Chromebooks—that hasn’t quite happened yet.

The above information and more can be found in the new Q3’23 edition of Market Watch. We have changed the format of the report from a heavily narrated version to a heavily charted version for easier consumption. Also, we have added server and client CPU shipment data back to Q1’21 and GPU-compute (GPGPU) shipment data back to Q1’21 for AMD, Intel, and Nvidia. We have expanded the pivot data array to include those devices.

JPR also publishes a series of reports on the graphics add-in board market and PC gaming hardware market, the latter of which covers the total market, including systems and accessories, and looks at 31 countries.

Pricing and availability

JPR’s Market Watch is available in electronic and hard-copy editions, and a single issue sells for $3,000. This report includes an Excel workbook with the data used to create the charts, the charts themselves, and supplemental information. The annual subscription price for JPR’s Market Watch is $6,000 and includes four quarterly issues. Full subscribers to JPR services receive TechWatch (the company’s exclusive access to daily news).

About Jon Peddie Research

Jon Peddie Research has been active in the graphics and multimedia fields for more than 30 years. JPR is a technically oriented multimedia and graphics research and consulting firm. Based in Tiburon, California, JPR provides consulting, research, and other specialized services to technology companies in various fields, including graphics development, multimedia for professional applications and consumer electronics, high-end computing, and Internet-access product development. JPR’s Market Watch is a quarterly report focused on PC graphics controllers’ market activity for notebook and desktop computing.

熱門頭條新聞

- Hong Kong Pavilion First Show in China International Cartoon & Animation Festival

- 2024 Hong Kong Animation and Video Game Festival

- Revolutionizing Legal Work: How Robin AI Accelerates Contract Review

- TyFlow brings Stable Diffusion AI directly into 3ds Max

- Gamescom 2024

- TRANSFORMERS: GALACTIC TRIALS HEADS TO CONSOLES AND PC THIS OCTOBER

- STAKE YOUR CLAIM IN KINGDOM, DUNGEON, AND HERO OUT NOW ON STEAM

- MBC’s Shahid platform announces premiere of ‘Grendizer U’