German games market grows by 17 per cent in 2021

German games market grows by 17 per cent in 2021

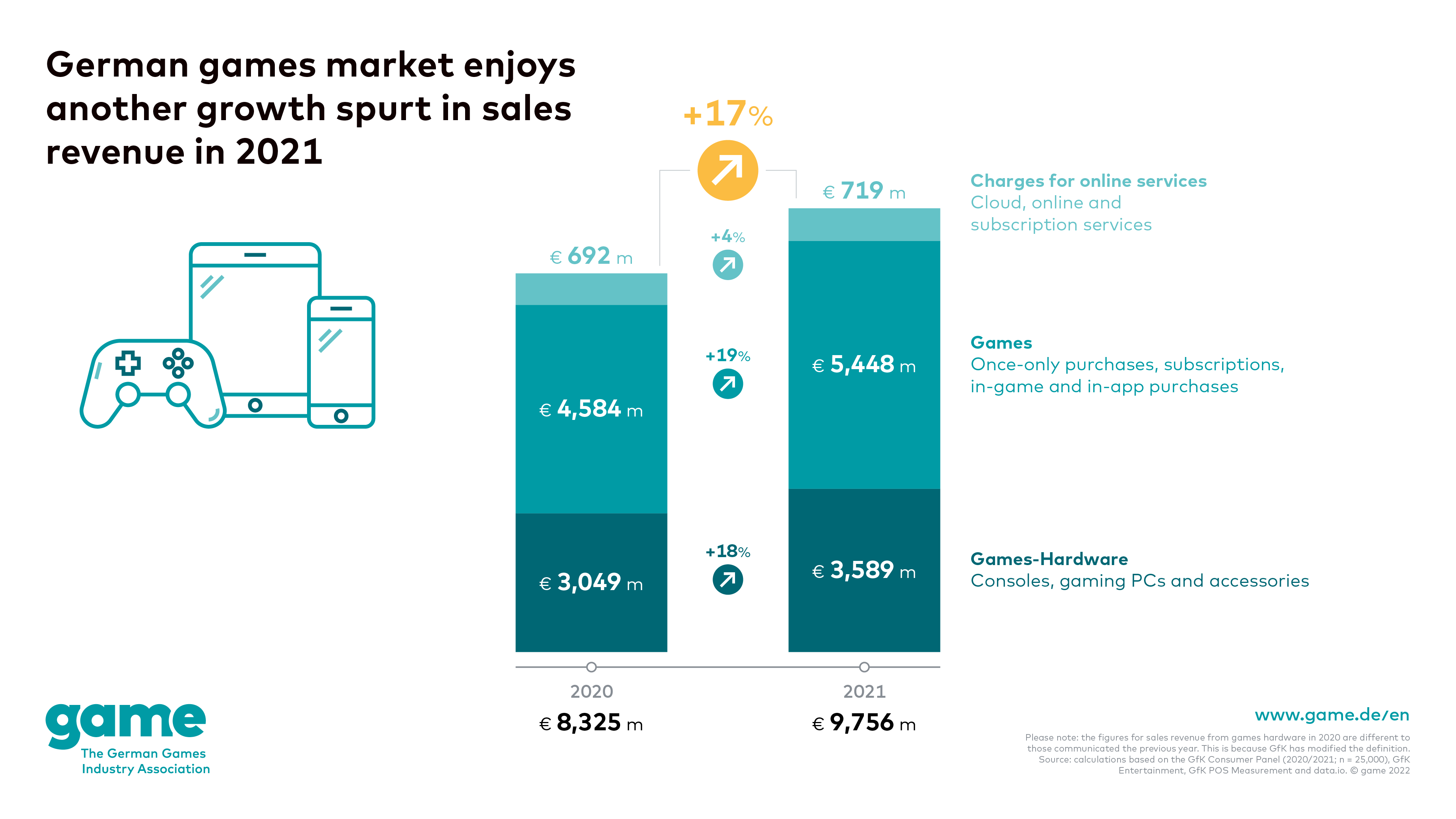

- Sales revenue from games and games hardware in Germany grew by 17 per cent to about 9.8 billion euros

- Games, games hardware and charges for online services: all three market segments posted growth once again

- The trend continues: games hardware, in-game and in-app pur-chases play an outsized role in driving market growth

The German games market has followed up its historic growth spurt in 2020 with yet another year of significant growth: in 2021, approx-imately 9.8 billion euros in revenues were generated from games, charges for online services and games hardware. This is an increase of 17 per cent com-pared to the previous year. Already in 2020, the German games market was able to grow by 32 per cent, which was due in part to the growth in new video game players that resulted from the Covid-19 pandemic. These are the numbers released today by game – the German Games Industry Association, based on data collected by the market research companies GfK and data.ai. The demand for games hardware, particularly for games consoles (+23 per cent) and acces-sories for gaming PCs (+22 per cent), as well as in-game and in-app purchases (+30 per cent), was the biggest driver of growth.

According to Felix Falk, Managing Director of game: ‘Following the historic growth spurt in 2020, the German games market continued its strong perfor-mance with significant growth in 2021. This also demonstrates that the people who first took up playing during the lockdowns are still enjoying it. We are partic-ularly delighted by the strong growth in games hardware. No matter whether they are using games consoles or gaming PCs, Germany’s video game players once again invested considerable sums in their equipment to ensure that they would be able to continue enjoying their games in the best possible quality in future. In fact, demand in some cases exceeded supply, meaning that it would have been possible to increase sales revenue by even more.’

Games, games hardware and charges for online services: all three market segments posted growth once again

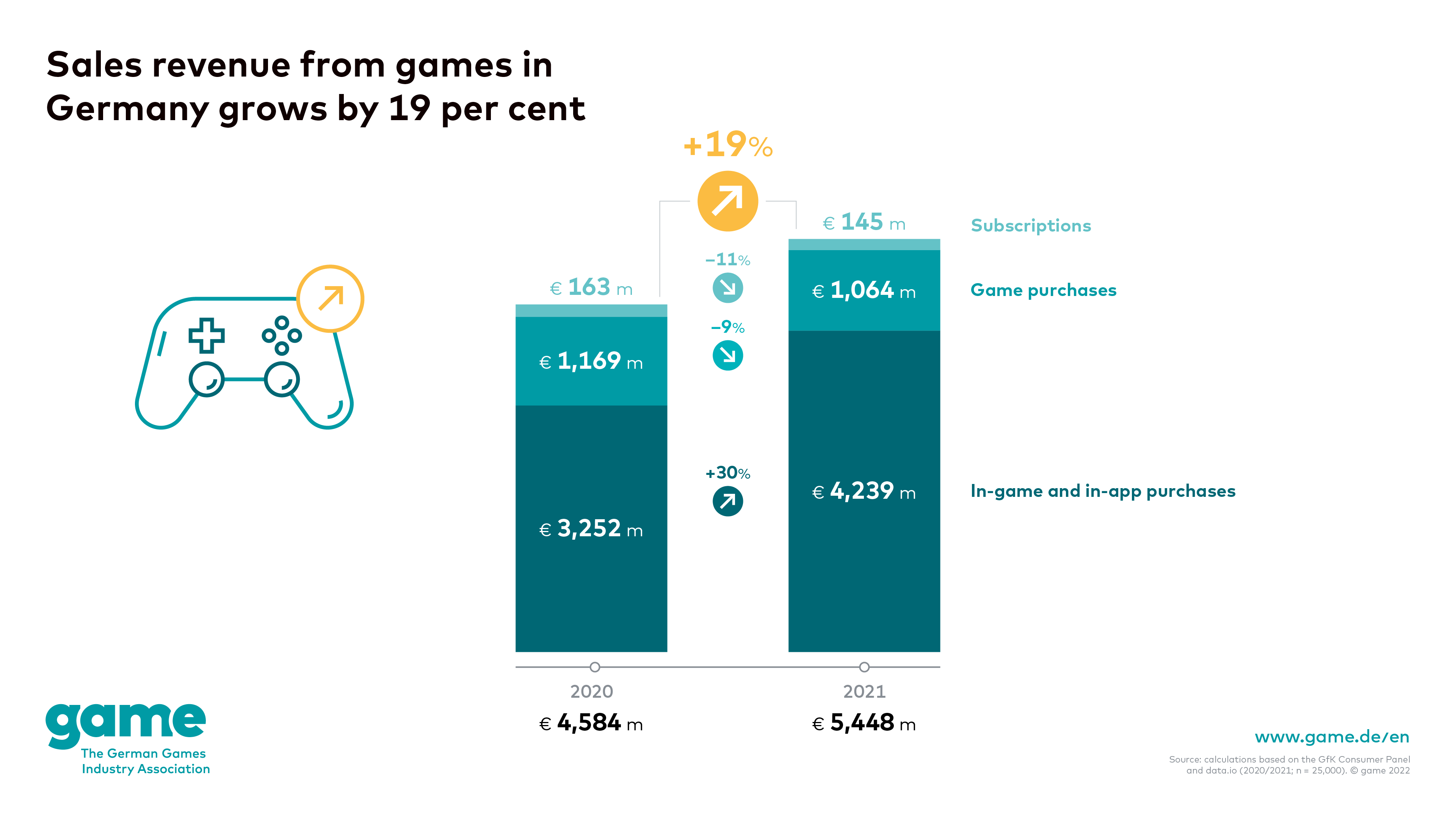

Sales revenue from purchases of computer and video games grew by 19 per cent to about 5.4 billion euros. So-called in-game and in-app purchases were once again the biggest driver of growth here, with sales revenue increasing by 30 per cent overall to about 4.2 billion euros. This is happening in response to a sustained trend towards free-to-play games, as well as a general increase in the length of time that individual titles are being supported with the frequent addition of new free and charged content. Sales revenue from the once-only purchase of games, on the other hand, fell significantly, by 9 per cent to about 1.1 billion eu-ros. Sales revenue through monthly subscription charges for individual games – a model that is common among online role-playing games – also fell, by 11 per cent to 145 million euros.

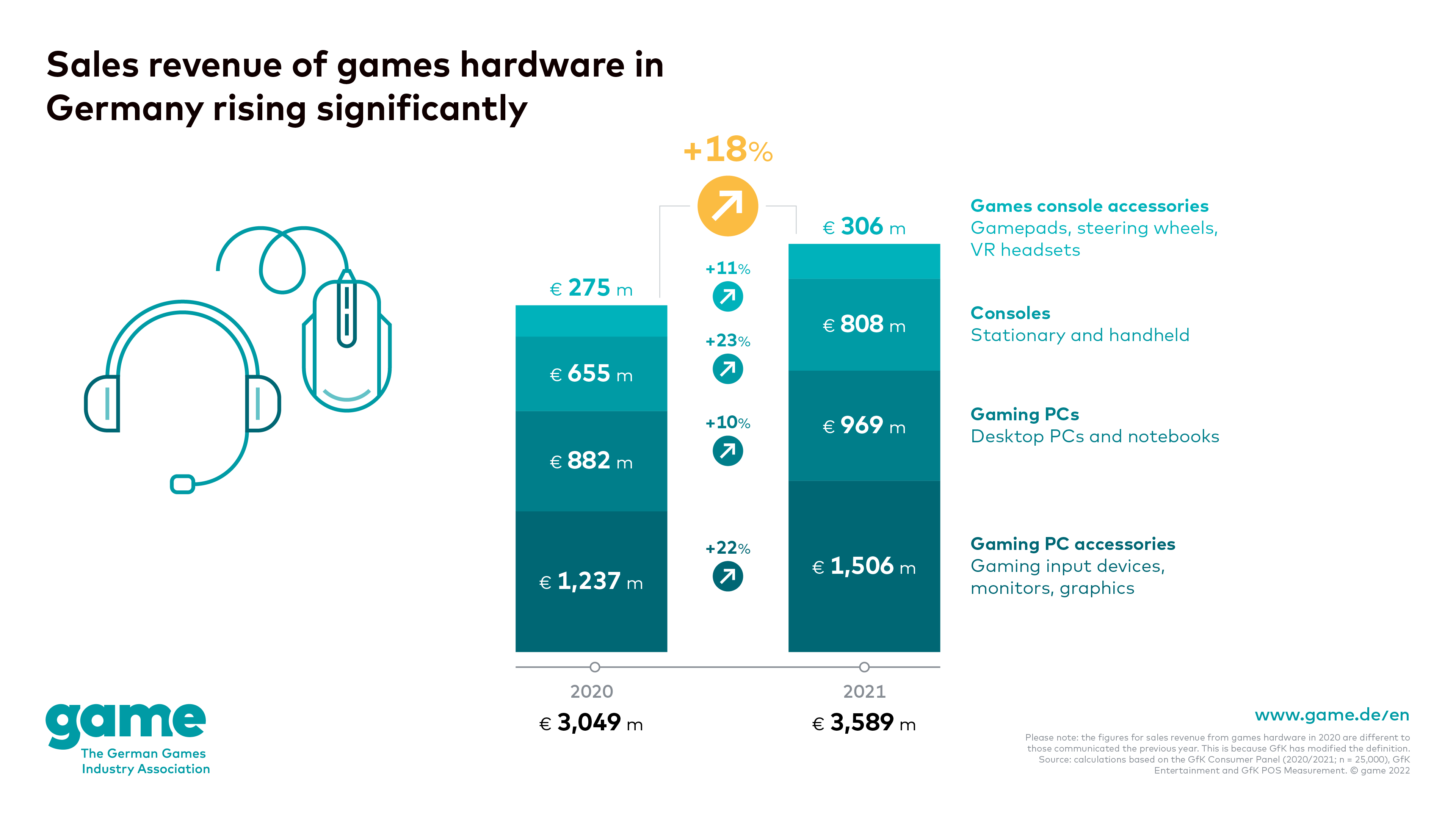

Sales revenue from games hardware grew by 18 per cent overall to about 3.6 billion euros. Games consoles are in particular demand: although retailers were often sold out of some models, sales revenue still managed to increase by 23 per cent to 808 million euros. Approximately 1 billion euros were generated from sales of gaming PCs – both desktops and laptops. This is an increase of 10 per cent compared to the previous year. More and more video game players are also investing in accessories to make their experience even better. Demand for graphic cards, keyboards, mice, monitors and VR headsets for gaming is espe-cially strong. Sales revenue from purchases of gaming PC accessories grew by 22 per cent to about 1.5 billion euros. Sales revenue from games console ac-cessories increased by 11 per cent to 306 million euros.

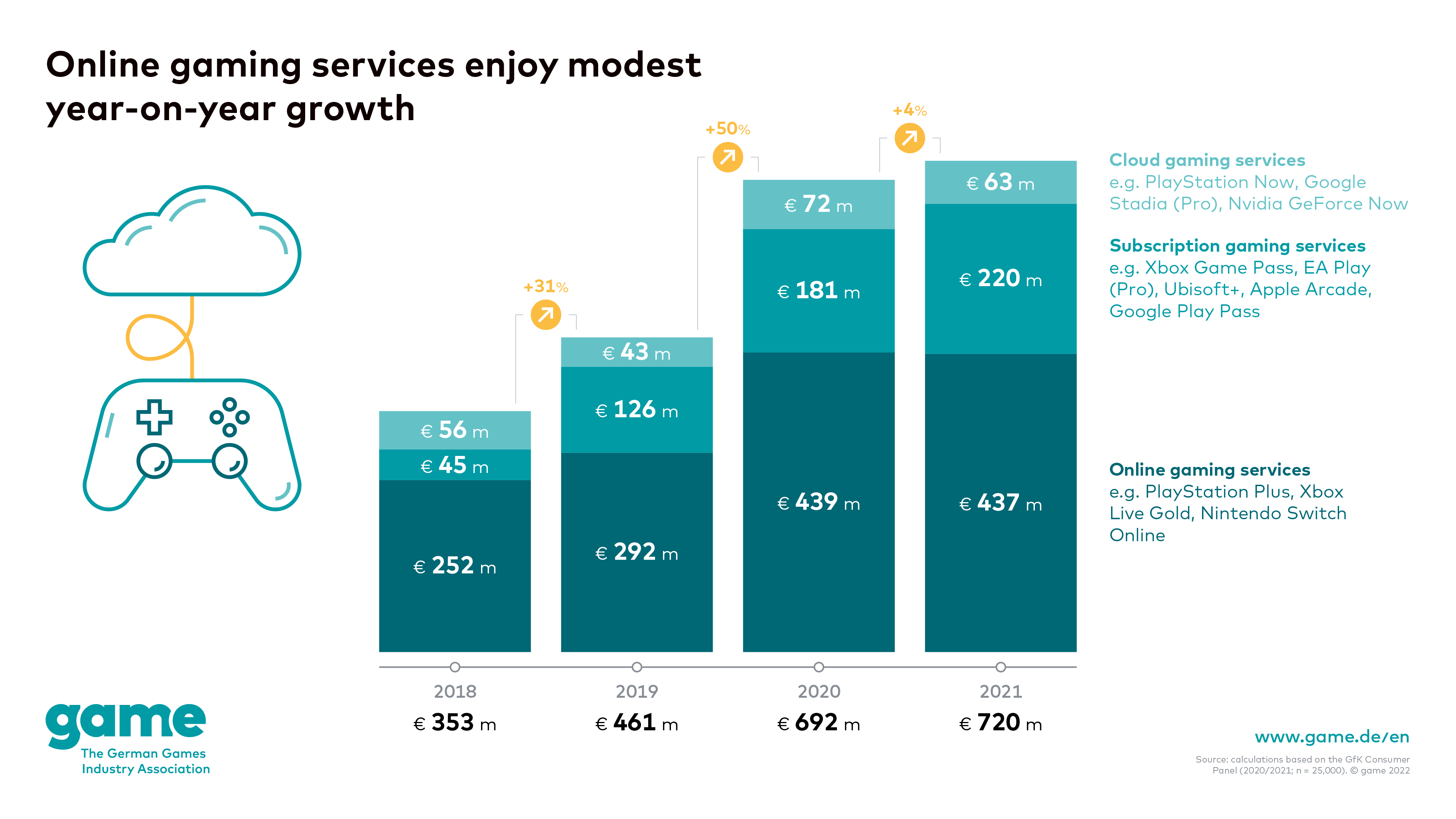

Following a huge 50 per cent leap in growth in 2020, sales revenue generated by online gaming services rose by an additional 4 per cent to 720 million euros in 2021. Gaming subscription services such as the Xbox Game Pass, EA Play and Ubisoft+ made a key contribution to this growth, with their sales revenue increas-ing by 22 per cent to 220 million euros. Cloud gaming services, on the other hand, experienced a decline of 13 per cent to 63 million euros. One of the rea-sons for this is the fact that some cloud gaming functions have been integrated into other services free of charge, meaning that no independent sales revenues are generated for these functions. Sales revenue from online gaming services also fell, by 2 million euros to 437 million euros. These are frequently offered for various games consoles and include – depending on the specific offer – free monthly games, games discounts, the ability to play online, or even cloud stor-age for saved games.

About the market data

Please note: GfK has modified the definition of gaming PCs. In order to make it easier to compare data, this new definition has also been used for the market data from 2020, whereby the games hardware figures that result are somewhat lower than those that were communicated one year ago.

The market data is based on statistics compiled by the GfK Consumer Panel and data.ai. The methods used by GfK to collect data on Germany’s video games market are unique in terms of both their quality and their global use. They in-clude an ongoing survey of 25,000 consumers who are representative of the German population as a whole regarding their video game purchasing and us-age habits, as well as a retail panel. The data collection methods provide a unique insight into the German market for computer and video games.

game – the German Games Industry Association

We are the association of the German games industry. Our members include developers, publishers and many other games industry actors such as esports event organisers, educational establishments and service providers. As a joint organiser of gamescom, we are responsible for the world’s biggest event for computer and video games. We are an expert partner for media and for political and social institutions, and answer questions relating to market development, games culture and media literacy. Our mission is to make Germany the best games location.

Source:Game

熱門頭條新聞

- NG25 Spring

- Maintain Altitude’s Revolutionary Music Game Secures $500k in Pre-Seed Funding Led by Hiro Capital

- Doloc Town Announced – A Cozy Farming Sim with Unique Mechanics and Retro Platforming Charm

- Road To Ninja:Naruto The Movie

- Lighting the Creative Spark of Artificial Intelligence – The first International Conference on Artificial Intelligence and Creativity was Successfully Concluded

- V-Ray 7 coming soon to Blender

- Japan prime minster pledges support for content industry at Tokyo film festival opening

- Nintendo cuts its operating profit forecast