Chasing Netflix: How the Major Media Companies Stack Up in Subscribers, Revenue, and Challenges [Part Five]

Apple TV+ and Prime Video Are Streaming Wildcards

Apple TV+ and Prime Video, two tech-driven platforms, do not disclose quarterly subscriber or ARPU figures, making them more difficult to compare directly with traditional media companies. However, both platforms represent significant competitors in the streaming space due to their deep pockets and ability to bundle services with other offerings.

Apple TV+ has focused on premium original content, while Prime Video benefits from its integration into Amazon’s broader ecosystem, which includes e-commerce and cloud services. Prime Video recently launched an ad-supported tier, signaling its intent to compete with Netflix and Disney+ in advertising.

While Prime Video boasts some original content, it does not have as many original titles as top competitors Netflix and Hulu. And, many films and series content must be rented or purchased.

According to Whip Media’s 2023 U.S. Streaming Satisfaction Survey, Apple TV+ saw significant improvement in its content catalog, with viewer satisfaction rising for its original series and films. Apple TV+ has risen to prominence, ranking #4 in overall subscriber satisfaction, with an impressive 5-point increase from 2022, reaching 81%. Apple TV+ continues to outpace both Netflix and Prime Video in overall user satisfaction.

In a significant milestone, Apple TV+ became the first streaming service to win an Oscar for Best Picture with “CODA” at the 2022 Academy Awards, just three years after the platform’s launch.

While these platforms may not dominate the subscriber count or ARPU rankings, their unique business models and financial backing make them formidable players in the streaming wars. Both Apple and Amazon have the resources to experiment with new content strategies and distribution models, which could disrupt the streaming market unexpectedly.

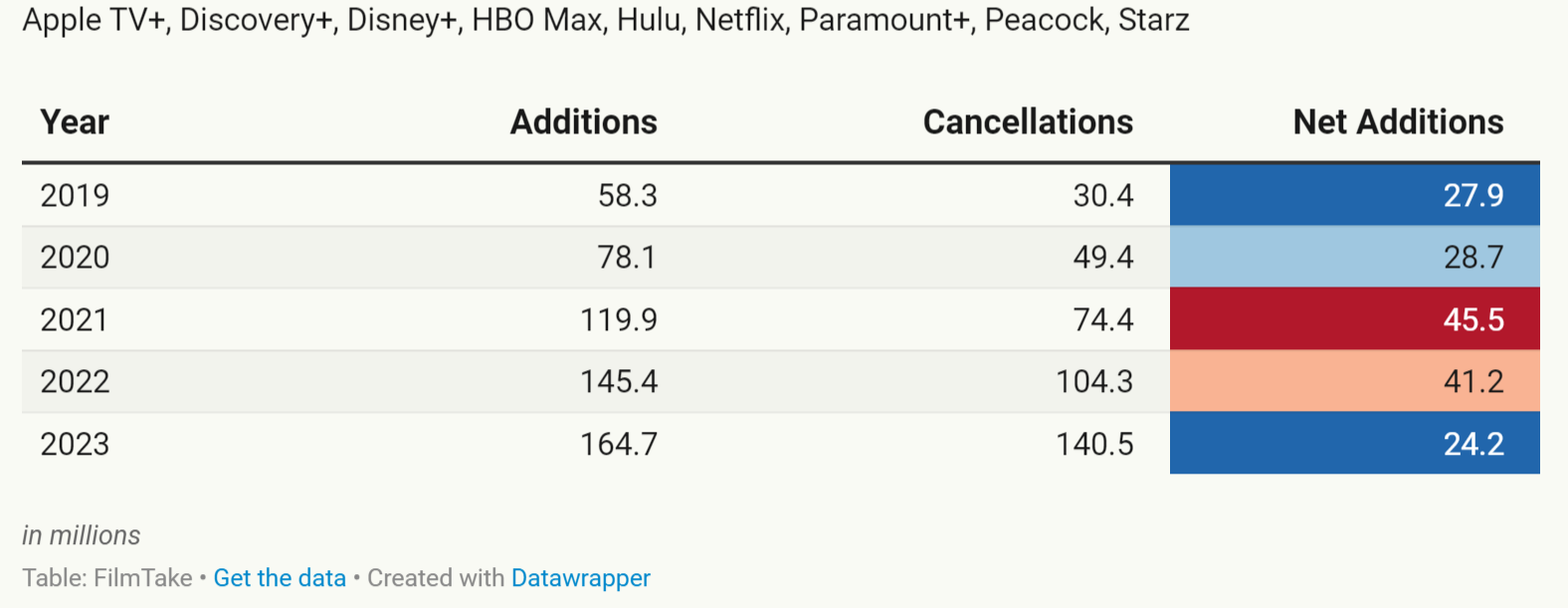

Bundling as a Strategy to Reduce Churn

Bundling has emerged as a popular strategy among streaming platforms to reduce churn and retain subscribers. By offering multiple services at a discounted rate, platforms like Disney, WBD, and Paramount can lock in subscribers who might otherwise cancel their subscriptions.

The recently launched bundle of Disney+, Hulu, and Max is one example of how legacy media companies leverage their content libraries to offer more value to consumers. These bundles reduce churn and help platforms increase ARPU by encouraging subscribers to upgrade to higher-priced tiers.

However, bundling also presents challenges. Platforms must carefully manage the pricing of their bundles to ensure they are competitive without eroding profit margins. Additionally, bundling requires effective content curation to ensure subscribers feel they are getting value from all the package services.

US Premium SVOD Churn Rates

The Ongoing Challenges Facing Streaming Platforms

While the major streaming platforms have made significant strides toward profitability, challenges remain. For many, password-sharing continues to be a significant issue. Netflix, Disney+, and others have recently implemented or plan to roll out measures to curb password-sharing, a practice that has been a longstanding headache for platforms looking to maximize revenue. However, the impact of these crackdowns remains to be seen—will they lead to increased revenue or alienate subscribers accustomed to sharing their accounts?

Additionally, the expansion into international markets presents both opportunities and risks. While international growth offers platforms access to millions of potential new subscribers, the ARPU in many markets is significantly lower than in the U.S. and Europe. Platforms must strike a delicate balance between expanding into new territories and ensuring they can turn a profit from these regions.

As consumer preferences evolve, ad-supported tiers are becoming an increasingly important component of many streaming platforms’ strategies. Offering lower-cost, ad-supported options allows companies to capture price-sensitive audiences while generating revenue through advertising. However, this shift requires platforms to develop sophisticated advertising technologies and partnerships, which can take time to implement and refine.

Source:Filmtake

熱門頭條新聞

- The CES® 2025

- ENEMY INCOMING! BASE-BUILDER TOWER DEFENSE TITLE ‘BLOCK FORTRESS 2’ ANNOUNCED FOR STEAM

- Millions of Germans look forward to Christmas events in games

- Enter A New Era of Urban Open World RPG with ANANTA

- How will multimodal AI change the world?

- Moana 2

- AI in the Workplace

- Challenging Amazon: Walmart’s Vision for the Future of Subscription Streaming