Can CD Projekt Recapture the Magic?

It’s been a while since we looked in on Polish outfit CD Projekt. The publisher and developer of The Witcher and Cyberpunk 2077 franchises plus PC game platform GOG.com is bringing a relatively quiet year to a close. So we thought it’d be a good time to check in on its progress through this transitory phase and explore the company’s future plans.

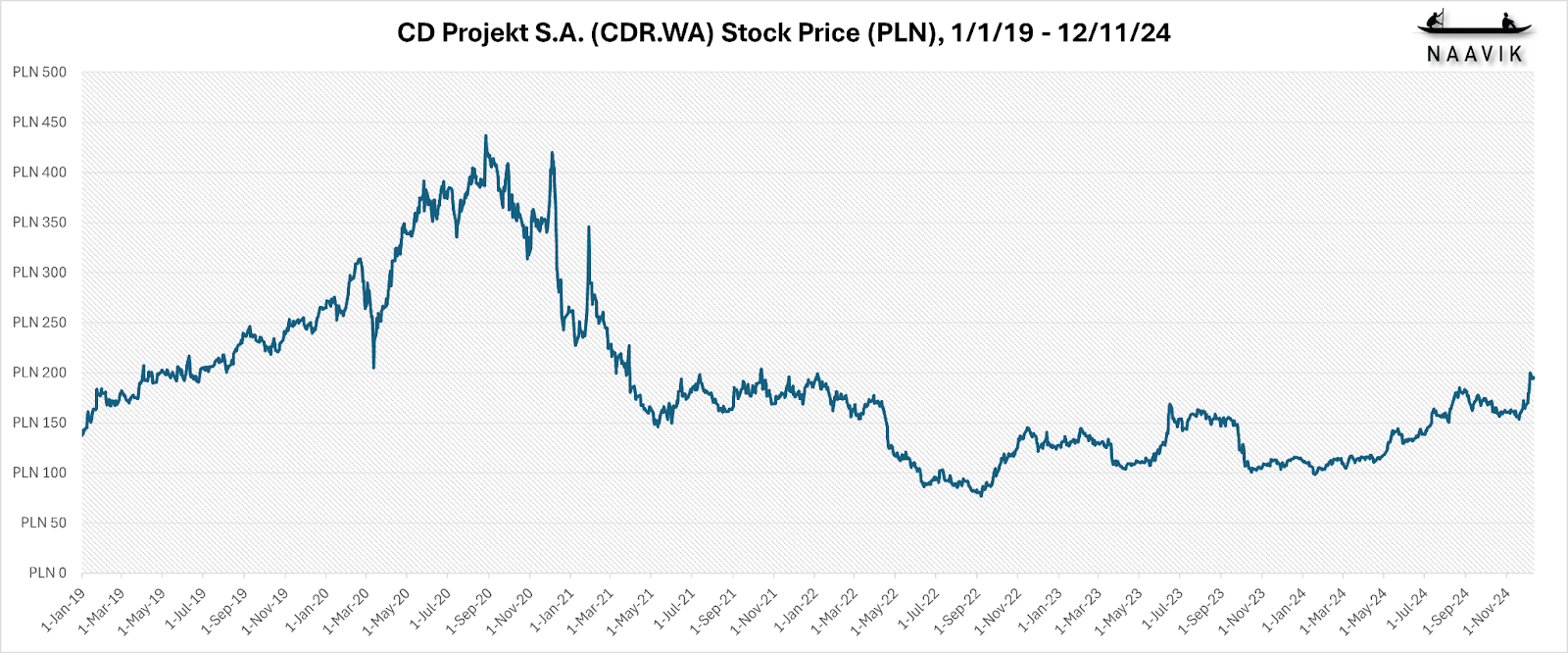

The company’s stock price is hovering around the same range at which it started to trade in 2019 — nearly four years after the 2015 release of The Witcher 3: Wild Hunt. Joint CEOs Adam Badowski and Michał Nowakowski find themselves four years removed from another major release, Cyberpunk 2077.

Source: https://finance.yahoo.com/quote/CDR.WA/history/?period1=1546300800&period2=1733964871&guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZHJvcGJveC5jb20v&guce_referrer_sig=AQAAAJwq7qyj8EKyFv9Vy2-taXuc5cQDZthyecNFJtV6hFxfo9w-3j2JldV_FgUZvck261mZwA6ABhpqEFQfzUfJBK3N21JaahNTs1ke_Fv8naRpHbuLzoJlnO8ZpLJWOEvG_VUT23att_9OpFv5kea4q-3Ar2SDG3jINRn63JTgtCOB

CD Projekt Stock Price (CDR.WA) 1/1/19 – 12/11/24 | Source: Yahoo Finance

As has been widely reported, the extreme hype surrounding Cyberpunk’s launch, combined with its disappointing performance, resulted in a precipitous drop in the company’s share price. Though CD Projekt has done an admirable job reinvigorating the game with quality-of-life improvements, bug fixes, and new content, the company has yet to fully recover the momentum it had in 2019 and 2020.

Cyberpunk 2077 Aftermath

Indeed, CD Projekt has largely kept its proverbial head down in the years following the infamous Cyberpunk 2077 launch. It has several projects in varying stages of development, but the firm’s third quarter earnings report suggests there are at least two or more years of additional production and R&D ahead before anything new hits the market. So, what does a company dependent on tentpole releases do between product launches?

For starters, CD Projekt is in the midst of a multiyear transition away from blockbuster releases and toward what Joost van Dreunen described in a recent newsletter (via CD Projekt Chief Marketing Officer Jeremiah Cohn) as “more sustainable engagement touchpoints, such as strategic updates and brand-expanding partnerships.”

More than simply playing the transmedia game (though it’s definitely doing that, too), CD Projekt has sought to grow awareness of its franchises through a variety of game partnerships, including with Balatro, Naraka: Bladepoint, Guilty Gear Strive, Destiny 2, Fortnite, and many others. These activations have helped to support the continued longevity of both The Witcher 3 and Cyberpunk 2077, released in 2015 and 2020, respectively. According to CD Projekt’s Q3 earnings report, revenue for The Witcher series increased 44% year-over-year to 54.4M PLN (about $13.2M USD), while Cyberpunk surpassed 30M copies sold life-to-date and raked in an additional 115.6M PLN (around $28.1M USD).

Though overall revenue for the quarter was down year-over-year, the company faced tough Q3 ‘23 comps due to the release of Cyberpunk’s Phantom Liberty DLC, which sold over 8M copies. CD Projekt has also continued to invest in Cyberpunk while transitioning staff to new projects. Since its release, the game has added a fully functional metro system, an overhauled police system, new mission content, new vehicles, and a new suite of customization options, among many other changes and improvements.

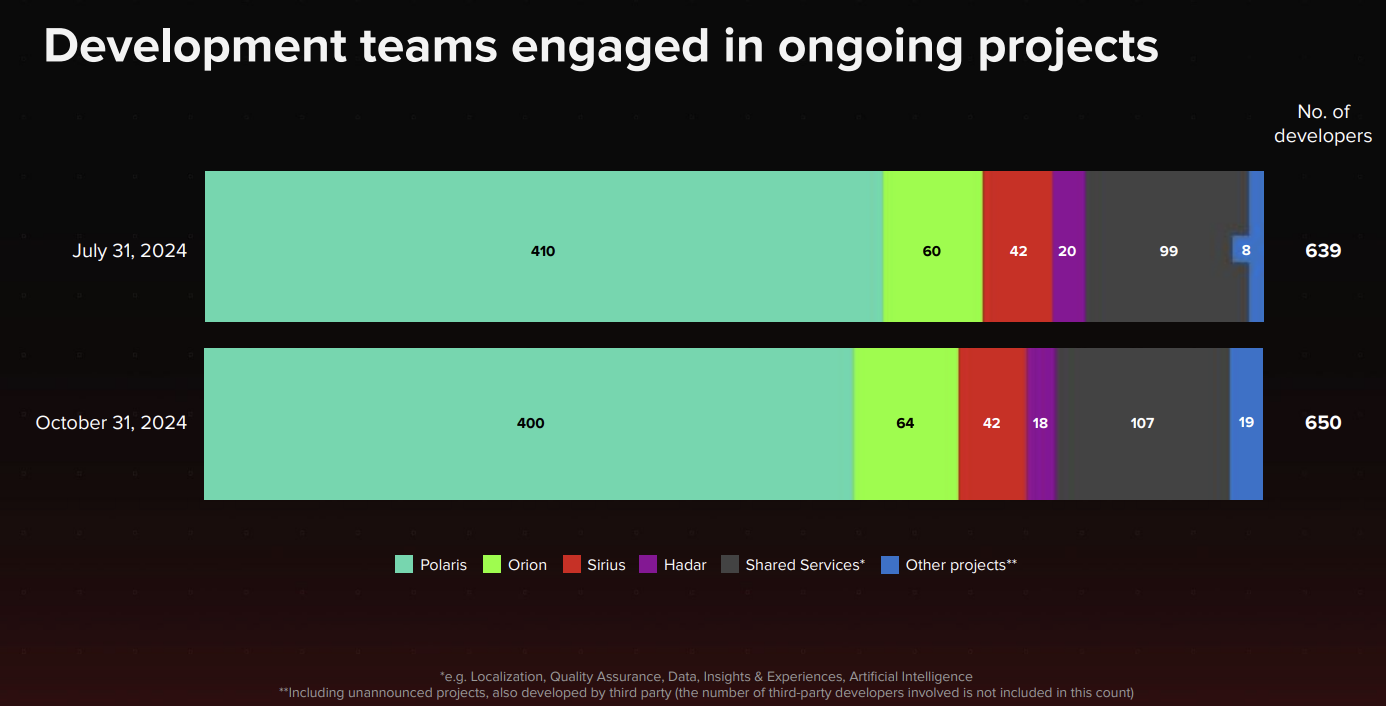

It’s hard to know how many developers remain on Cyberpunk today, and the recently released 2.2 patch was developed alongside French outfit Virtuos. However, by comparing a recent company fact sheet with the chart below (pulled from the Q3 earnings report), we can see that more than half of the CD Projekt staff is on new projects.

Source: https://www.cdprojekt.com/en/wp-content/uploads-en/2024/11/cd-projekt-group-presentation-q3-2024-1.pdf

Source: CD Projekt

The most noteworthy of these games to date is Project Polaris. Described as the first installment of a new Witcher trilogy, this game recently entered “full-scale production” and houses nearly two-thirds of the employees staffed on new games. A first trailer was unveiled at The Game Awards on December 12th, revealing a few interesting tidbits. It will be titled The Witcher 4, and its main character will be Ciri, the magical princess-turned-witcher who featured prominently in both The Witcher 3 and in the Netflix series. This departure from the original trilogy’s hero Geralt of Rivia implies changes to combat and a less impartial protagonist, with Geralt being famously neutral and ambivalent.

Perhaps more interesting, however, will be the team’s shift from a bespoke engine to Unreal Engine 5. This potentially improves CD Projekt’s ability to execute quickly, onboard new talent, and develop at higher fidelity. Assuming this transition goes smoothly, the company may use the same tech for its other early-stage projects.

Speaking of which, there are a few other projects of note beyond The Witcher 4.

Project Orion: the successor to Cyberpunk 2077, built out of CD Projekt’s Boston and Vancouver studios.

Project Sirius: a multiplayer Witcher spin-off game being developed by Boston-based The Molasses Flood (acquired in 2021).

Project Hadar: a new original IP about which very little is known. Note that both The Witcher and Cyberpunk were based off of existing intellectual properties, while Hadar is expected to be entirely new.

Project Canis Majoris: an Unreal Engine 5 remake of The Witcher 1, in development by Polish studio Fool’s Theory.

In addition to these projects, the company continues to dabble in the world of Gwent. Though the mobile card game from The Witcher universe was sunset last year, the company has licensed out the IP for release as an all-new physical version in 2025.

All told, the company is looking at a future built on its two existing franchises, with some long-term hopes for a third IP. Interestingly, the strategy is somewhat similar to that of fellow European publisher Remedy (which Naavik covered here a few weeks ago).

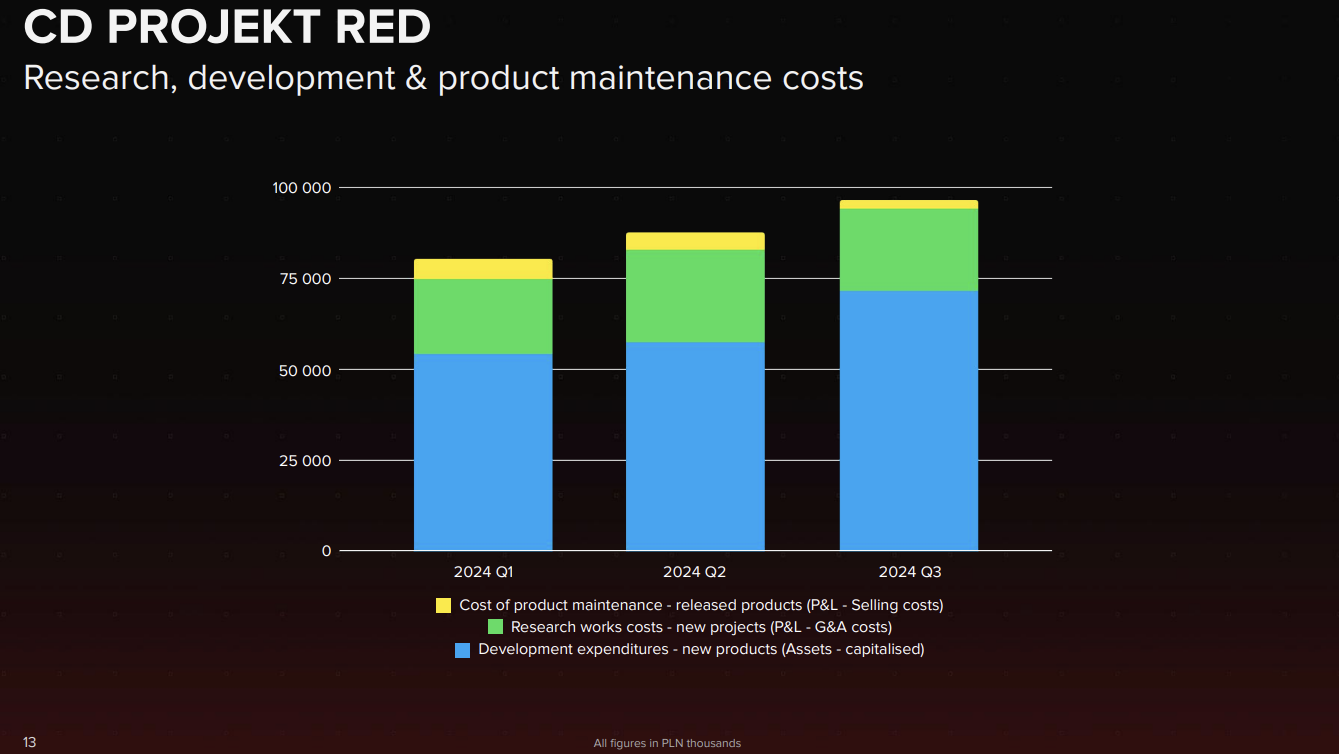

Further emphasizing this focus on the future has been the 391% year-over-year increase in R&D spending in Q3 ‘24. Though CD Projekt has maintained a healthy gross margin of 67%, it would be fair for investors to assume that development expenses and research costs will continue to rise in the years leading up to the release of The Witcher 4 (or whichever project crosses the finish line first).

Source: https://www.cdprojekt.com/en/wp-content/uploads-en/2024/11/cd-projekt-group-presentation-q3-2024-1.pdf

Source: CD Projekt

Perhaps in anticipation of the market’s reaction to the coming years of investment, CD Projekt also announced in its recent earnings call a proposal for new financial targets. The company is shooting for 4B PLN (about $994.9M USD) in net profit over the next four financial years (January 1st, 2025 through December 31st, 2028), well above analysts’ expectations of 3B PLN (approximately $746.2M USD) and double the 2023-2026 profit goal. The hope here is to better align incentives for employees and executives alike in executing against the company’s lofty goals for its new titles. To quote the company board, the proposal “is ambitious, and achieving it will be dependent upon effective implementation of projects envisioned by the CD Projekt Group development strategy, and the commercial success thereof.”

Nevertheless, as R&D costs have risen, and catalogue sales have begun to wane, CD Projekt has also pursued cost control measures. The company underwent layoffs in 2023 and 2024, prompting staff to unionize under the banner of the Polish Gamedev Workers Union. Development of at least one project, Witcher spin-off Project Sirius, has already been pared back and reevaluated.

In retrospect, the dedication and continued investment (reportedly $125M) in turning around the failed Cyberpunk launch was essential for laying the foundations of future growth; Project Orion likely would have never happened if CD Projekt had simply moved on to new projects after Cyberpunk 2077. The success of the turnaround may have even bolstered the confidence of the board in proposing these aggressive new profit targets. Clearly, management is bullish on the company’s ability to ride out the years of investment and R&D ahead. This begs the question: Should investors believe them?

Future Outlook

While the aforementioned strategy of collaborating “with experienced quality-focused partners in expanding [the company’s] franchises to new fields of entertainment” has resulted in numerous IP crossovers for both of its core franchises, it’s hard to imagine this resulting in meaningful profits — especially as both core IPs become longer in the tooth.

We’ve seen other companies bolster product pipelines during fallow years by working with third-party studios for smaller games, mobile spin-offs, remakes, and/or remasters. We already know CD Projekt is working on a remake of the original Witcher game, and there’s no reason to believe that won’t continue with The Witcher 2: Assassins of Kings. It’s also quite likely the company is working with outsourced studios on additional projects not reflected in the staffing charts shown above. It’s hard to judge the potential impact of these (admittedly speculative) projects, but it feels safe to assume they will have a larger influence on the company’s bottom line than any marginal IP collaboration.

It’s also worth evaluating the company’s PC gaming platform, GOG.com. Formerly known as Good Old Games, this business is focused on back catalog and classic titles. GOG was also among the first businesses to offer consumers DRM-free game downloads. Unfortunately for CD Projekt, GOG operates in the same space as Steam and the Epic Games Store, and has struggled to turn a profit. In its Q3 earnings report, GOG.com posted a 41% year-over-year decline in revenue and continues to operate at a loss. GOG’s player-focused approach and its emphasis on game preservation is admirable, but unlikely to drive significant profitability.

So where does that leave CD Projekt? If we assume two to three years of production for The Witcher 4, we can pencil in a major spike in revenues for holiday season ‘26 or ‘27. If history is any indicator, we should also expect additional hikes from The Witcher 4 DLC six months to a year later. Perhaps the remake of the original Witcher comes sooner, in ‘25 or ‘26? And, as long as we’re speculating, we might even see The Witcher 4 release coinciding with the start of a new console cycle.

With all that said, it’s difficult to see how the company is going to transition away from its dependence on mega-releases, based on what’s been revealed publicly. With the difficulties of the Cyberpunk 2077 launch still relatively fresh in the minds of company leadership, we can assume CD Projekt will handle future tentpole launches with greater care. Indeed, a slow and steady approach may be the most prudent, given the company’s relative lack of experience with anything outside of epic single-player open-world RPGs.

Taking the time to acclimate to different types of projects (remakes, third-party development), parallel development tracks, and new UE5-enabled workflows may help to lay the foundation for future acceleration in years to come. CD Projekt may never truly escape the ebb and flow of multi-year development cycles, but its current efforts could help drive higher peaks and extend longer tails when those major releases finally arrive.

Source:Matthew Dion, Naavik Contributor & Founder at Always Scheming/CD Projekt

熱門頭條新聞

- Global Game Jam Partners with Games for Change for the First G4C University Student Challenge

- Qualisys: Streamlining Mocap Today, Exploring What’s Next

- XSOLLA AND UKIE ANNOUNCE PARTNERSHIP AT GDC 2025 TO EMPOWER GAME DEVELOPERS IN THE UNITED KINGDOM AND THROUGHOUT EMEA

- “One of the Best Platformers of 2025” Ruffy and the Riverside Announces June 26th Release Date on PC & Consoles!

- Overwatch star Matilda Smedius to host NG25 Spring!

- SAG-AFTRA National Board Meets via Videoconference

- Double Dragon Gaiden: Rise of the Dragons Free DLC Coming Now

- Take a look back at Latvian animation spotlight at CARTOON MOVIE!