Alibaba Sells Gao Xin Retail for HK$13.1 Billion

On the evening of January 1, 2025, Alibaba Group announced in a public notice that it would sell all of its shares in Gao Xin Retail, the parent company of RT-Mart, for up to approximately HK$13.138 billion, representing 78.7% of Gao Xin Retail’s issued shares. The buyer is CDH Capital.

Since 2014, Alibaba has been aggressively expanding its presence in the physical retail sector, investing in Intime, acquiring Gao Xin Retail, and investing in leading enterprises such as Suning, Jujing Home, and Red Star Macalline. The new retail movement was once in full swing; ten years later, Alibaba has gradually divested these “non-core assets” through external sales and equity transfers to subsidiaries. Currently, the only entity still under Alibaba’s control is Hema Fresh, which it built from scratch.

From “buying and buying” to “selling and selling”, Alibaba’s development strategy in the retail industry has undergone a significant change, shifting from a dual focus on online and offline to a concentration on online business.

Gao Xin Retail’s main business formats include RT-Mart, RT-Mart Super, and M Member Store, corresponding to hypermarkets, medium-sized supermarkets, and membership stores. As of the end of September 2024, Gao Xin Retail had 466 hypermarkets, 30 medium-sized supermarkets, and 6 membership stores across the country.

In 2017, Alibaba invested HK$22.4 billion to acquire a 36.16% stake in Gao Xin Retail. In October 2020, Alibaba increased its investment by HK$27.957 billion, raising its stake to 72%. Alibaba’s total investment in Gao Xin Retail was HK$50.357 billion.

Alibaba’s stake in Gao Xin Retail is divided into two parts: one part is held through its wholly-owned subsidiaries Jixin and Taobao China, accounting for approximately 73.66% of the total issued shares of Gao Xin Retail; the second part is held by New Retail, accounting for approximately 5.04%. New Retail is an investment company wholly owned by an investment fund over which Alibaba can exercise significant influence on investment decisions.

In October 2024, Gao Xin Retail announced to the market that there was a potential buyer interested in acquiring it. On the evening of January 1, 2025, the transaction was finally concluded, with CDH Capital offering a maximum of HK$1.75 per share for the acquisition, including HK$1.55 in cash and HK$0.2 in interest.

CDH Capital is a private equity firm. According to its official website, its team has led the private equity businesses of KKR and Morgan Stanley in Asia. It is backed by a diverse group of institutional investors, including sovereign wealth funds, pension funds, endowment funds, family offices, and fund of funds. CDH Capital’s transaction cases include Ping An Insurance, Mengniu Dairy, Haier Electric, Belle, Modern Dairy, and many others.

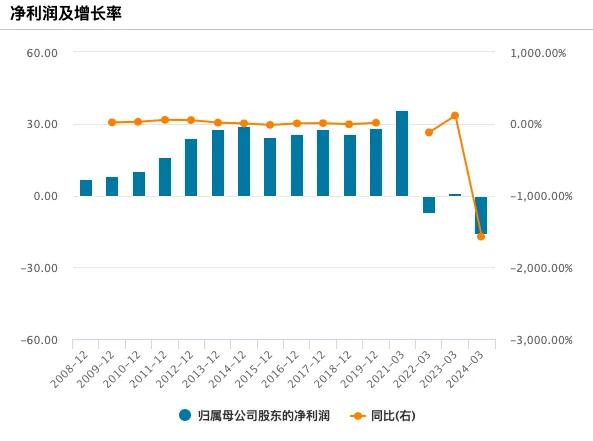

Over the past seven years, Alibaba has provided significant support for Gao Xin Retail’s digital transformation. Future business cooperation between the two parties will not be interrupted, and they remain very important business partners. This transaction is a strategic adjustment made by Alibaba to focus on its core business. The company’s overall business decisions, strategic direction, and core management team remain stable and largely unchanged. The CDH team is an international private equity investment institution. Its core team has led many domestic leading consumer and retail sector investment projects. They are long-term optimistic about the company’s development and share highly consistent views with the company on operations, strategy, and development. Seven years after being acquired by Alibaba, as the survival pressure on the supermarket retail sector has been increasing, the revenue and net profit of Gao Xin Retail have declined. In the fiscal year 2024, it suffered a loss of 1.605 billion yuan. Facing the pressure on performance, Gao Xin Retail made personnel adjustments in 2024. On the one hand, it closed some hypermarkets, and on the other hand, it continuously launched RT-Mart Super and M Member Stores, and intensified the promotion of its own brand products. According to the interim report of the fiscal year 2025 (ending September 30, 2024), the company’s revenue was 34.708 billion yuan, a year-on-year decrease of 3%; the net profit was 186 million yuan, a year-on-year increase of 149.2%. During the reporting period, the number of employees in the Gao Xin Retail Group was 85,778.

In recent years, including RT-Mart, Yonghui Superstores, Wuhan Zhongbai, etc., none of them have found a way to transform their modern business operations. Currently, there is an oversupply of hypermarkets, and the development of new formats has already eroded the former’s existing market. In the next step, there will be a significant reduction in the number of hypermarkets. From an investment perspective, the valuation of offline retail projects is currently at a low level and has certain investment potential.

On September 23, 2024, MINISO announced that it would acquire 29.4% of the equity of Yonghui Superstores for 6.27 billion yuan, becoming the largest shareholder of Yonghui Superstores. Yonghui Superstores is a leading offline retailer with a focus on fresh food supermarkets, but it has become a major loss-making company in recent years, with a total loss of over 8 billion yuan from 2021 to 2023. Yonghui has a large business scale and stable cash flow, and is an undervalued investment target in the market, which may become one of the growth engines for MINISO Group’s profits.

Since 2014, Alibaba has been laying out physical retail through a series of acquisitions, reaching the peak of the New Retail movement in 2017. However, in 2023, Alibaba established two strategic priorities: “user first” and “AI-driven”, began to focus on core businesses, and started the “sell-sell-sell” model, sorting out and downsizing non-core businesses. In February 2024, Alibaba’s traditional physical retail business was not a core focus, and its exit was very reasonable. However, due to the current challenging market environment, the exit process will take time. By excluding physical retail businesses such as Gao Xin Retail, Hema, and Intime, Alibaba’s group revenue in the current quarter would increase by approximately 8% year-on-year. In the fiscal year 2024, Alibaba divested non-core assets worth 1.7 billion US dollars.

熱門頭條新聞

- Farming Simulator Announces FarmCon 2025

- 11th Duhok International Film Festival Winners Announced

- Still There Launches on Epic Games Store with Special Discount!

- Announcing Xenopurge – A Real-Time Tactics Game Inspired By Aliens

- Alibaba Sells Gao Xin Retail for HK$13.1 Billion

- “Paddington in Peru “, a Live-Action Animated Adventure Comedy Film

- Grand Prizes for “Beautiful Man” and “Memoir of a Snail” at Cinanima 2024

- FragPunk’s March 6th 2025 Release Date Revealed at The Game Awards